Posts

-

Culinary Wanderlust for Body & Mind

Hello from Santorini, where the heatwave across Greece has finally broken and we’ve fallen down the rabbit hole into Instagram worthy views at literally every turn. It’s even better in real life with the smells, tastes, feeling of warm wind on skin, and air conditioning that is set to 27 Celsius and still requires me to sleep naked. I’ll be writing up the full trip later, but for now let’s catch you up on my adventures of the last 6 weeks or so!

Out and About

Scottsdale, Arizona

Aside from squeezing in some in-person roadmapping for our startup Groupthink, I attended the annual Kentucky Derby Day shindig hosted by my cofounder Jonathan and his lovely wife Regan.

Derby Day festivities Treats included many flavors of Kit Kat bars and other Japanese snacks from their recent honeymoon adventure to see the cherry blossoms and revel in the strong US Dollar.

We dined at modern Indian spot Feringhee in a strip mall in Chandler, AZ — and it was totally worth the drive. It’s a vegan-friendly spot that had been on Jonathan’s hit list for ages, and rolling up in the suburban parking lot provided a strong reminder that being snobby about neighborhood or curb appeal can cause you to miss out on so much in life!

not even half of what we ordered at Feringhee! Standout dishes included the Malabar crab cakes, Old Delhi butter chicken, and the pan puri trio which came in passion fruit, blackberry and mint self-served to fill little globes of puffed rice dough that had to be popped fully into the mouth before they disintegrated from the moisture. The timing of the whole process made it exciting!

Washington D.C.

I was in town for the Ash Carter Exchange on Innovation & National Security and the AI Expo for National Competitiveness, which were co-located this year as defense tech and AI trendiness have converged, making Dr. Carter’s vision more prescient than ever.

On my first night I hit the top spot recommended by my Twitter community: Rasika. The food reminded me of much loved (now closed) San Francisco spot August One Five, which was opened by our friend Hetal Shah and made it four years but sadly didn’t survived the pandemic. I hope for more modern Indian food all over the U.S. and I’m looking forward to tracking some down back in Denver.

I met up with a former member of my team at Gitlab (who’s now working on a nuclear energy startup — love this so much!) for drinks at Death & Co D.C. and dinner at Supra, the first Georgian restaurant I’ve ever tried and a newly recognized Michelin Bib Gourmand for 2023.

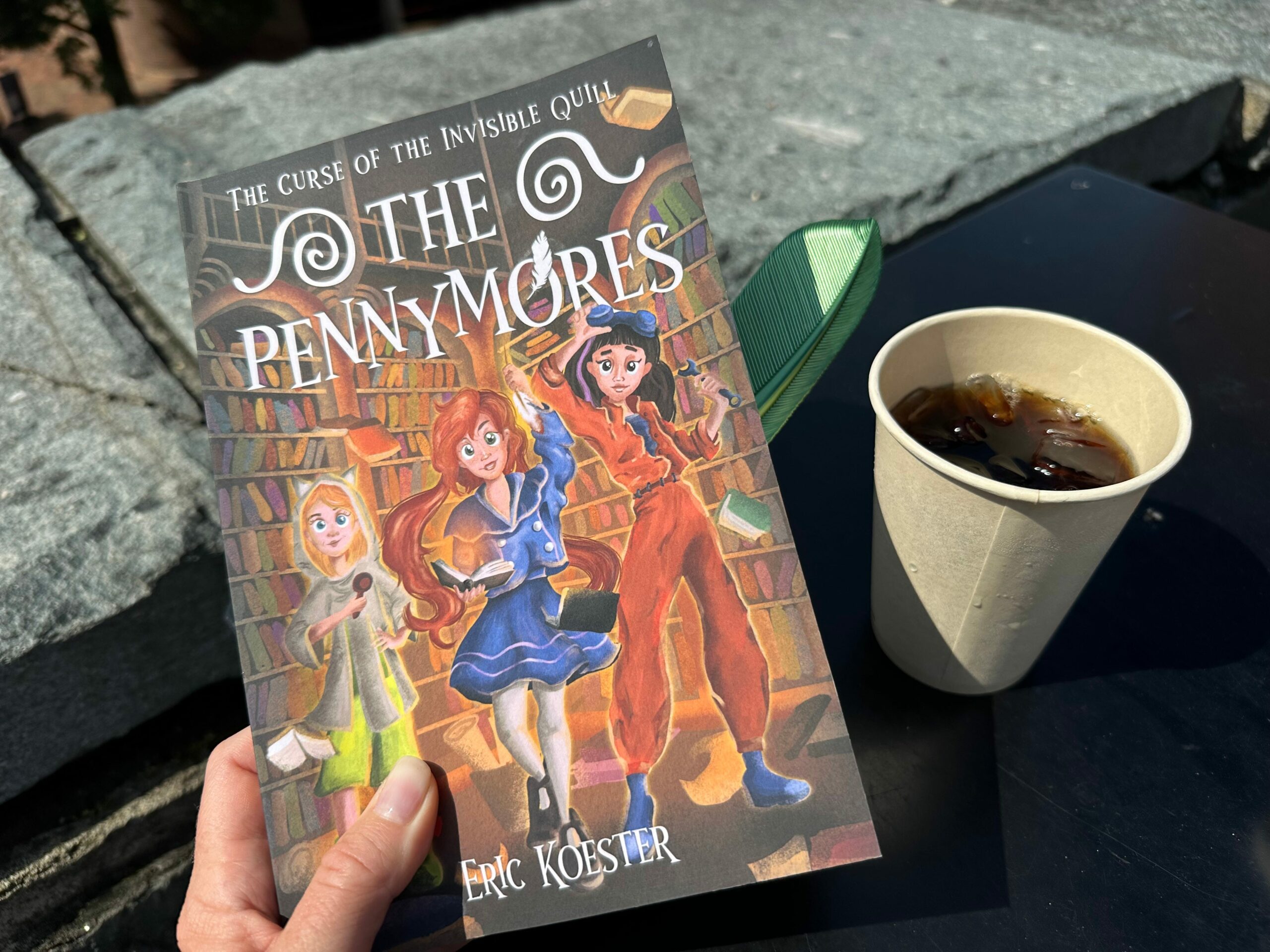

I also had the opportunity to re-connect with Eric Koester, who goes back to my Seattle startup days / Startup Weekend mafia / is the reason I got to travel to Reykjavik to give a TedX talk back in 2011. He’s now a published author many times over and known as “the book professor” at Georgetown University. I was most excited to hear about the creative process of writing a best selling book with his daughters during the pandemic!

The culinary highlight of the trip for me was the lamb sandwich at Levantine-inspired cafe Yellow (also Bib Gourmand) where I took no pictures of the sandwich itself, but I can tell you the foodgasm went on and on.

the coffee program at Levantine cafe Yellow is on point For my final evening, I solo dined and people-watched at the bar at Lebanese restaurant Ilili down at The Wharf.

Bozeman, Montana

The hunt for my perfect 100+ acre ranch property continues…

More snow. Seriously, I’m done with snow! Fortunately it melted as quickly as it came, and I made the rounds to Wild Crumb for pastries, finally had a meal at the James Beard recognized Little Star Diner, and even got to see the aurora borealis with friends!

I was so into the meal that I forgot to take pictures, which as with Yellow is among the highest praise I can offer.

Seattle, Washington

A last minute invite from my Mom to do Mother’s Day brunch came in while I was already traveling, and I thought “after being gone so long what’s another 24 hours on the road?”

It was so good to see my sister and my nephews, and this get together also marked my Dad’s first time out of the house since his knee surgery. It was good to see him up and about again, as it takes a combination of driving and riding a ferry boat to get to Seattle from my parent’s home, so I know it’s psychologically powerful for them to feel free to move about again. He’s been cleared to golf and ride his Peloton!

Back Home… for Jury Duty

In the two week stretch I’d hoped to be home to recharge from my domestic travel adventures before heading to Greece for my friend and former business partner’s wedding, I was selected to sit on the jury for a gruesome murder trial.

I’m not your true crime gal, and while I framed the inconvenience as doing my civic duty it was difficult. The medical examiner testimony and evidence of a strangling were viscerally disturbing, I found myself taking my job as a juror so seriously that I couldn’t sleep at night as I grappled with the burden of proof, and ultimately defendant was convicted of first degree murder.

One silver lining is that my friend Maria was also part of the jury selection panel for the first two days of voire dire, so we randomly got to hang out for several hours sitting on the hallway floors of the courthouse, trying to stay limber and get some work done.

Aspen, Colorado

The jury wrapped deliberations (after all that, I ended up being a randomly selected alternate!) the afternoon before we were slated to leave, so this became a much needed break from the stressful routine of reporting to the courthouse around 7:30am each day.

We’d hoped to do our annual shoulder season trip (aka pilgrimage to Meat & Cheese) over the top of Independence Pass, but thanks to a late spring snow storm it was still closed for the day we had planned so we took the long way on I-70 through Glenwood Springs.

For the uninitiated, Meat & Cheese is a sandwich spot worth driving 5 hours for and their cocktail program is perfection itself. Our default order is their Banh Mi riff and classic Italian, and both come with an ample side of the most delicious homemade salt and vinegar chips I’ve ever had.

My mouth just started watering as I typed that! Ughhh take me back! If you go for round 2 or with a group so you can try more things, I suggest skipping the famous chicken board and going for the tacos (usually fish and a rotating special — this time with lamb) and the mushroom French dip. Messy kissy fingers good.

We stayed at the Viceroy in Snowmass, which just re-opened from renovations and was basically empty and we had the pool and massive hot tub to ourselves. It’s dog-friendly so we’ll definitely be going back with the girls!

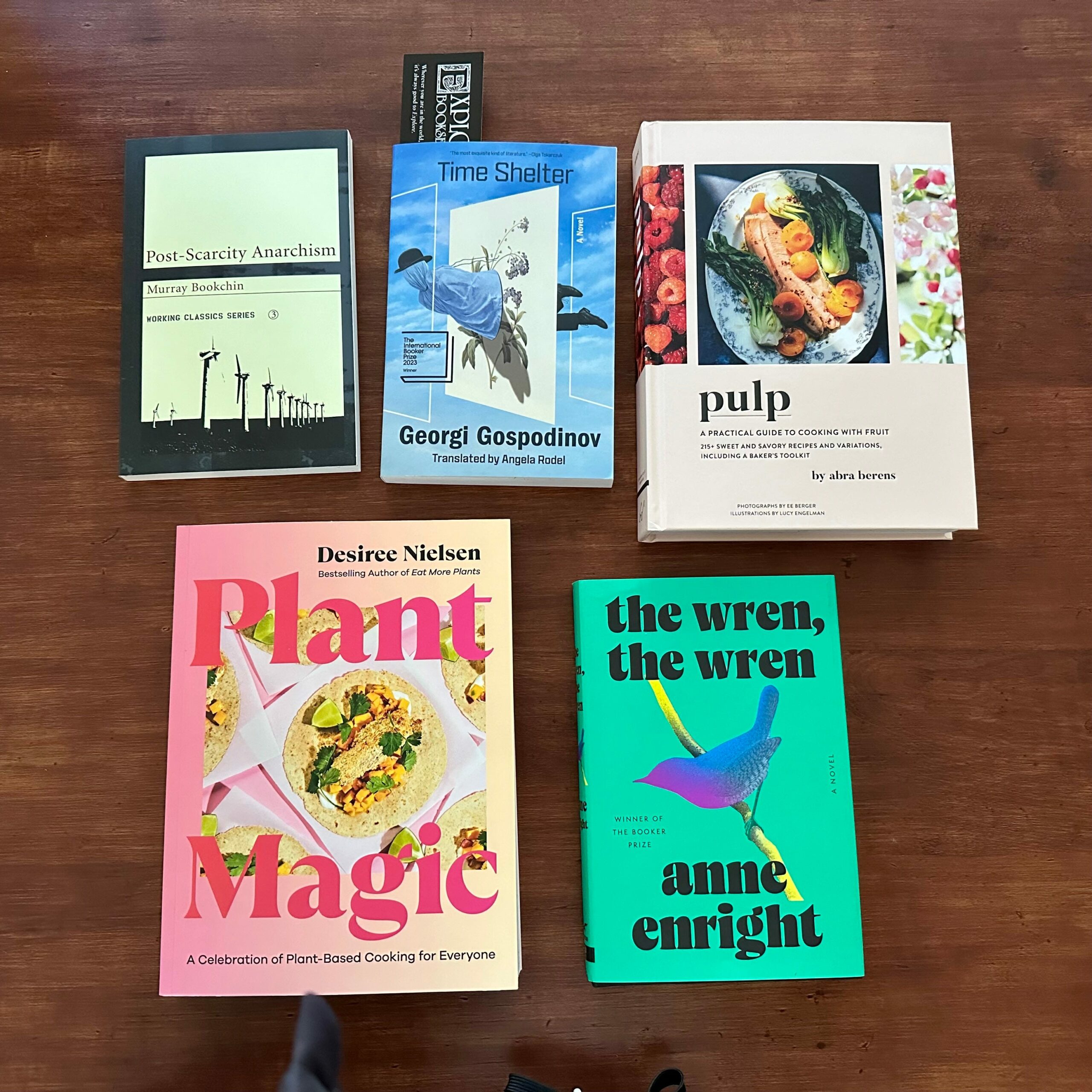

My haul from Explore Booksellers included Bulgarian speculative fiction novel “Time Shelter” by Georgi Gospodinov. It seems quite appropriate for the times we’re living:

A ‘clinic for the past’ run by an enigmatic therapist offers a promising treatment for Alzheimer’s sufferers: each floor reproduces a decade in minute detail, transporting patients back in time to a familiar, safer, happier moment.

Denver Farmer’s Markets

The start of the local farmer’s market at the beginning of May is really how I know winter is over. Cooking what’s fresh, seasonal and affordable is important to my idea of being a solid home chef.

I’ve visited the South Pearl Street Market on Sundays (local tip: go for the $15/bag all-you-can-fit produce stand) and City Park Farmer’s Market on Saturdays for the food carts and people watching.

Around the House

The Kitchen

After almost 5 years in our house it is time to have a place people can gather around that doesn’t require them to put their plates on their knees. I was telling myself a story that I can’t have people over because we don’t have a suitable table and guests will think we are weird. To unblock my hosting ambitions I found something that suits us: a bar height chef’s counter style table that also fits my “house as workshop” aesthetic.

One of the unexpected benefits of this setup: the dogs aren’t able to see the food, so they immediately lie down once I’ve served our meal.

The Garden

I’ve been enjoying warm mornings working and sipping coffee at the outdoor table in my garden, which we finished planting just in time to head out of town for a couple weeks in Europe. I’m grateful to friends and neighbors who’ve come by to check on the moisture levels in my absence.

Dahlia seedlings I grew from Floret Flower Farm seeds, waiting to be transplanted:

We finally got permission from the Dept of Forestry to have our street-side tree on the lot next door taken door, which is a relief as it had a very large dead bow over the street we feared might crush a car (or person!) in our next heavy wind storm.

The trunk and limbs were chipped into mulch which was spread across the lot to protect the topsoil and hopefully encourage more critters to move in and start improving the soil quality.

We’re looking forward to planting two new trees on the hell strip, depending on what the city and our neighborhood association will allow. I’ve got my fingers crossed for a flowering varietal!

My Dogs

Taco is living her best life, and looking quite gorgeous this spring as her winter coat sheds out and she resumes her daily ritual of holding court at Aviano. And by holding court I mean that I bring her, we sit, and everyone wants to approach her and comment or her beauty and pet her. It gives me a window into what it would’ve been like to be a popular blonde!

Emo is a bit fat, and fat labradors are something I’m accustomed to and on the watch for. We’ve got a bit of a “shake out the cup” plan in place, and I’m excited to see how she’s looking after 10 days of being out of town. As her momma I think she is perfect, but I also want to have her with me as long as possible so I appreciate my vet’s honest appraisal of her belly.

Media & Culture Worth Consuming

Nonfiction Books

- “Good Energy: the Surprising Connection Between Metabolism and Limitless Health” by Dr. Casey Means (or listen to her interview on The Huberman podcast)

- “Unreasonable Hospitality: The Remarkable Power of Giving People More Than They Expect” by restauranteur Will Guidara, former GM and co-owner of Eleven Madison Park and NoMad with Chef Daniel Humm

- “Autobiography of Benjamin Franklin” by Benjamin Franklin

Science Fiction Books

- “Children of Time” by Adrian Tchaikovsky

- “All Systems Red” by Martha Wells, first of the Murderbot series

Fantasy Fiction Books

- “The Goblin Emperor” by Katherine Addison

- “Cosmic Progeny” by A.V. Ray (space Daddy smut, you have been warned!)

What About the Startup?

So glad you asked. This blog has become a small way to prove to myself that I really do have a life outside of running my businesses, but that’s not because I don’t love them. I just can’t go back to my pre-2017 existence where my meaning and role and sense of importance and usefulness come from work accomplishments. I’m sure I’m building a new edifice of identity that will get torn down eventually, but I hope that comes from the ravages of aging on my body rather than the fickle tides of economic markets and unsustainable business models.

This time, I’m building a startup with network effects and an extremely low volatility cofounder configuration, so no matter what it can live forever. On average, each new signup to Groupthink generates 4.4 additional users and in the past few months that number has climbed to >10. We’re working on retaining new users, activating invitees, and keeping the whole flywheel humming with a team of 4 people. In a world where capital is expensive, cheap customer acquisition and strong retention cohorts are Everything. This is our North Star.

We’ve got about 2 years of runway and we’re hiring for a Senior Software engineer — so check it out at groupthink.com and get in touch if it looks like your jam!

Whew! Looking back on all this, it definitely feels like the cadence of life has swung to some new local maximum of social engagement, adventure, exploration and culinary consumption. Rather evaluate this for some deeper meaning I’m just in it, and I trust the ebb and flow will do what it needs to do with me. I will share that I was awaiting the results of a preventative cancer screening (all clear!) during this time so I do wonder if I was going harder in the face of mortality?

Here on the patio on day seven of my time in Greece, I’m losing track of time and that’s the freest feeling of them all. Maybe I’ll even take a nap.

Until next time, xoxo

elle

-

Putting a Bow on My Birthday Month

and a few things worth wanting (scroll down for a gift guide)

In case you’re catching up after not reading for awhile, I’m on a break from Twitter and using this blog as a place to share more of my day-to-day life. You can also follow me on Goodreads and see the combination of philosophy and smut I consume voraciously.

My weight-loss journey continues, and I reached a really important milestone: I’m officially down 60 pounds, and right on the cusp of no longer being medically “overweight”. After doing quite a bit of research, I decided to move my intermittent fasting into maintenance mode and start cooking plant-based high protein, high fiber meals and go mostly vegan. Fortunately, I shared my research with my husband and he’s been down to meal plan and prep cook!

Using a shared list in Apple Reminders to keep a running list of meals planned, shopping items, and recipe inspiration for next up has been working really well for us and it’s pretty cool to see him getting more and more confident with his kitchen skills and creative with ideas for what to make.

After returning from San Francisco we had a few nights back home, and whipped up these goodies. Please let me know in the comments if a recipes post is a good idea.

roasted veg + red pepper hummus, butter braised gochujang tofu, vegan taco bowls Groupthink Team Week in Arizona

For our week in Scottsdale we found an awesome Airbnb just down the street from my cofounder’s house, ordered groceries to be delivered right when we arrived, and were able to unpack and cook a healthy meal as if we lived there.

We hit some really lovely early spring Arizona weather, dry and barely touching 75 degrees Fahrenheit most days, and it was fun to bust out these neon pants I unearthed from my basement clothing collection:

It was a week of eating, catching up, coding, grilling, and even hitting golf balls!

grilling in Jonathan’s back yard

Top Golf Shenanigans

epic good food and even better company at Cochina Chiwas When we got home, I was thrilled to see my seedlings really starting to take off! I’m excited to start swapping with friends, neighbors and even complete strangers on Facebook marketplace in a few more weeks.

Work also started on the lot next door, which we are slowly transforming into a garden now that the house has been demolished and the ground is no longer frozen. At first we thought we would do the work of improving the soil, grading, installing drainage and rockery ourselves but I am so glad we didn’t! It took a team of 4 people and a backhoe 3 days to do this work.

Before

After

There’s still a LOT more to do, including taking down the fence that separates the two lots and starting to place large potted plants in different locations to get a sense for sun exposure readings through the growing season. All very exciting!

While it’s too early for much in my own garden, Kevin and I took a walk over to Denver Botanic to get a dose of colorful blooms on the first warm day.

We kept things low key for my 39th birthday, and Kevin took the day off to hang out with me. I also received beautiful flowers from my loved ones. Thank you 🙂

And of course we got a spring snow storm the next day! Fortunately our trees had recently been pruned so the heavy blanket of snow didn’t break off any branches.

I’m definitely ready to be done with snow for awhile.

Last, but possibly most important update for those of you who follow me for the food stuff — Kevin and I made the Eleven Madison Park granola recipe (it’s the same as what they give guests on their way out to enjoy the next morning… or you know, in the Uber). And it is glorious! Highly recommend making it.

Shopping Guide: A Few Things Worth Wanting

Spring cleaning has me shopping my own house, turning up lightly used candles, smudge sets, bubble bath, silk pajamas, spring handbags, sandals, and so many random kitchen gadgets. As I take stock of what we have, what we need, and what we’re giving away I’ve also made some purchases I’m absolutely thrilled with!

Long ago in another life I had a Y Combinator startup called Referly where we helped our users recommend products and get paid, so making this shopping guide feels like a little nod to that past. However, I’m too lazy to track down referral links for all these products (and the universal affiliate link generator still doesn’t exist!) but please know I have bought — often multiples — of everything I’m sharing with you here.

In the Kitchen

Charles Heidseick Rose Reserve — I’m not drinking much alcohol these days as part of my push to eat clean and get lean, but when I do I like to order the same champagne we enjoyed at Saison when Jonathan and I had our cofounder dinner in San Francisco. This drinks dry and if you had your eyes closed you might not even guess it’s a rose at all.

scenes from my dinner with Jonathan at Saison! For No-ABV cocktails my go-to spirit is still Monday non-alcoholic gin

Clothes

After getting rid of more than 20 bags of clothes that no longer fit, I’m in the process of re-stocking my wardrobe and it’s leading me to re-think my personal style. While I love fashion, I don’t need it much since my lifestyle outside of working on my businesses revolves around gardening, cooking, roadtrips and my dogs. I have classic staples that I’ll probably get tailored down, so for now I’m focused on the casual functional pieces for the warm weather months.

Isabel 3.0 Pants from Wondery Outdoors — just got these in Ochre and Agave and they’re incredibly comfortable, soft and flattering on the butt.

Forme Power Bra — for improving posture while living an active life.

Teva Voya Infinity Sandals – squishy and comfy, but a little cuter than the ones I wore growing up (…but don’t worry, I bought a pair of those too!)

Z Supply Sloane Tank Mini Dress — so comfy it doubles as a sleep dress

Ribcage Wide Leg Jeans in Splash Zone – 30 inch inseam is the way

Self Care

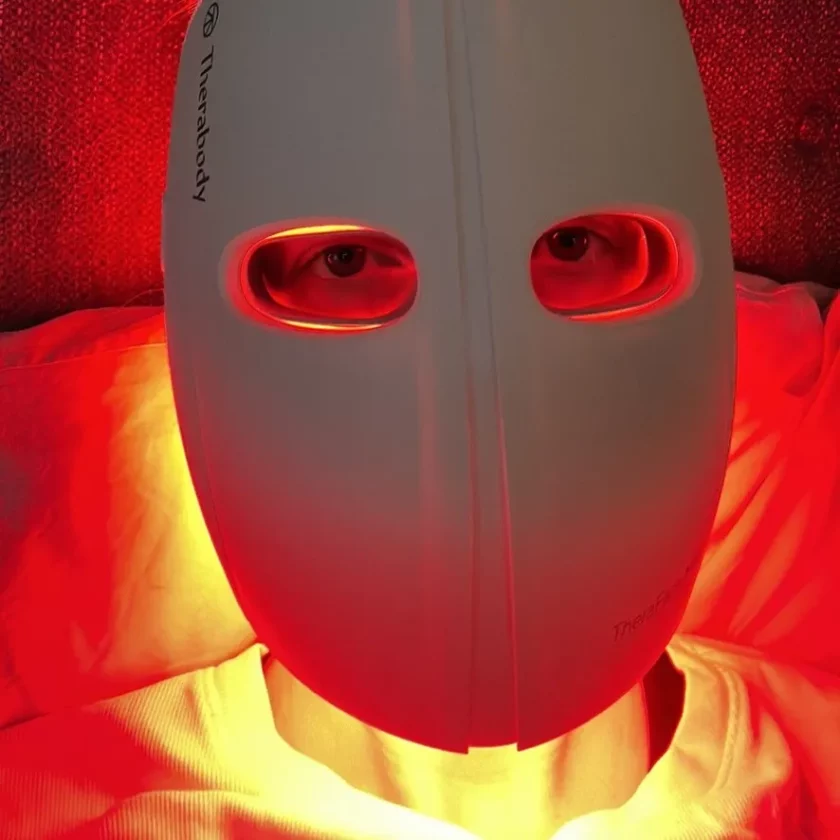

TheraFace LED Mask — by Therabody, the company that makes Theragun. It sits on a stand, and I had it on the bookshelf next to my bed and when Emo (our black lab) made eye contact with it, just sitting there, her hackles went up!

Smythson Portobello Notebook in Panama – love to get mine personalized, my favorite color right now is Nile Blue but hoping they’ll bring back Olive

Summer Sleepwear

Lunya Washable Silk Bias Slip Dress – I have this in blue, lime, and pink

Eileen West Iconic Swiss Dot Cotton Nightgown

Cheers to thriving in all the seasons, shopping our own closets, and aspiring to want what we already have. GO NUGGETS!

Elle

P.S. What do you think of the “old school” style of blogging? Do you read anyone else who does this kind of life posting in long form who you’d recommend I check out for inspiration? Thanks!

-

Training the LLM in My Head

Lately, I feel like I am unlearning how I use the Internet.

This weekend I deleted all my posts on X (fka Twitter) and removed the app from my phone. This isn’t the first time I’ve attempted a cleanse of this particular channel and I can’t guarantee I won’t be back (though I have managed to stay off Facebook for nearly 2 years now). As the place where I have my largest following, it’s the most tempting to turn back to when I have something I want to get out to the world — particularly when it comes to promoting my startup or portfolio companies. But I’m not sure who I’m really reaching there, or what the quality of that attention is. I’d rather just pay for ads. If that even works anymore. Lately, I’ve found hyper-targeted direct email outreach to be a more effective customer acquisition channel but I’ve been out of the growth game for a hot second while building so I’m sure I’ll have more to say about that in the coming months.

So what am I consuming information-wise?

First and foremost are books, and I remain committed to finishing 100+ per year (tracked on Goodreads) and my habit tracker right now is committed to a minimum of 95 minutes spend reading per day. Thanks to Audible I can easily get this in while doing chores, walking the dogs, working out and gardening and I’m probably reading 3+ hours per day on average. Enough where I actually journaled yesterday that perhaps my habit tracker should function more as a maximum.

There’s something about reading “too much” (I have a hard time really believing that is a thing) where I can get very in my head, a little disconnected from the world — especially if I’m reading fiction with a really compelling world and characters who are in the midst of resolving a conflict. I’ll find myself living in the mood of the book with them until I see it through. I also struggle with this when reading academic non-fiction (I recently slogged through the final 20% of “Envy: A Theory of Social Behaviour” just to get in a fresh headspace). Whenever this happens, my strategy of simultaneously reading multiple books is out the window until I’ve resolved my obsession by either finishing the book or abandoning it on purpose. Books that make me feel this way are usually worth finishing, I just have to pour a weekend into them and then have a bit of an emotional hangover.

On the lighter side, when it comes to periodicals I’ve been reading a lot more on Substack, subscribing to randomly interesting publications to see what else the algorithms will bring me. It’s been pleasantly surprising to break beyond my filter bubble (to some extent) and find some weirdos. For now I don’t want to turn this into a highlight list just yet because it makes me worry I’ll become too self-conscious about my exploration, but you can see what I’m subscribed to on my profile if you’re really curious.

Deleting all my posts on X got me pondering what it would be like to shelve all the books I have “In Progress” on Goodreads (>500), Audible, and Kindle and start my reading spidering approach from scratch. I doubt all of these are “In Progress” by any stretch (I’d be willing to wager I’ll finish ~20% of them in my lifetime) but it’s daunting to approach the idea of cleanup. Same for my playlists on Spotify.

I turned 39 last week, and I’ve been an adult on the Internet with a blog for 20 years and I wish there were better tools for telling people who I am now. People still talk to me about Twilio, or Mattermark, depending on where our lives intersected and there doesn’t seem to be a space where I can point them to catch them up. I guess that’s why I keep blogging, but who other than my stalker is going to read through ever single one of these. I don’t even want to read through. them. Perhaps I’ll send the LLM back over all the journals like Dan Shipper.

As we live closer and close to the possibility of electronic life forms trained on the things we write on the Internet, I feel like it matters more than ever that we have all these navel-gazing posts for these beings to draw from. Something with a little more entropy, with a little less predictability. Is my reading diet just the training fodder for my own internal LLM? I wonder.

-

Getting Some Narrative Continuity

This is a cross-post from my Substack “Little Drops of Happiness” — go there to get the full post with all the pictures, and subscribe there to get notified about new posts by email.

It’s been about 7 months since my last post and life has picked up a new faster cadence. This change sits at the confluence of waning grief, renewed enthusiasm for being out in the world, memories of the pandemic starting to fade, my startup gaining traction, and transformation of key relationships. Hello, hi there, it’s me!

After nearly 20 years and ~500 posts I find myself craving some kind of narrative arc on my blog. I re-read it and remember my life but when enough time passes, it can be difficult to tie things together. I’m an old school blogger, mixing in my personal life we other musings and I like to have a single place where the big life stuff is noted because otherwise I have to look across a lot of different social media accounts. Now that I’m down to just Twitter (still refuse to call it X) and Insta it’s a lot easier because Twitter = text and Insta = pics.

So in order to unblock myself to write smaller posts about more recent events, and keep this in some semblance of chronological order, here are some highlights of life since I last opined on the glorious summertime in the Rocky Mountains.

September ‘23

Nashville for the first time! Exploring with Jonathan and Regan, and driving to Gatlinburg to celebrate another friend’s wedding in the Great Smoky Mountains.

Highlights: an emo sing-along in country bar, snacks from Buc-ee’s, and a day at Dollywood . I loved traveling with the whole Groupthink crew for this one!

Back in Colorado, we headed up into the Rockies to see the fall leaves, grill burgers, ride the UTV, and sit around the bonfire. We were up early for a hike among the Aspens turning orange in Arapaho National Park, and went out on a friend’s boat for its final run of the season.

October ‘23

Montana to see friends for the last of the warm weather! Two hikes, including my first time up “The M” at Bridger Canyon — a 850 ft climb in just over a mile.

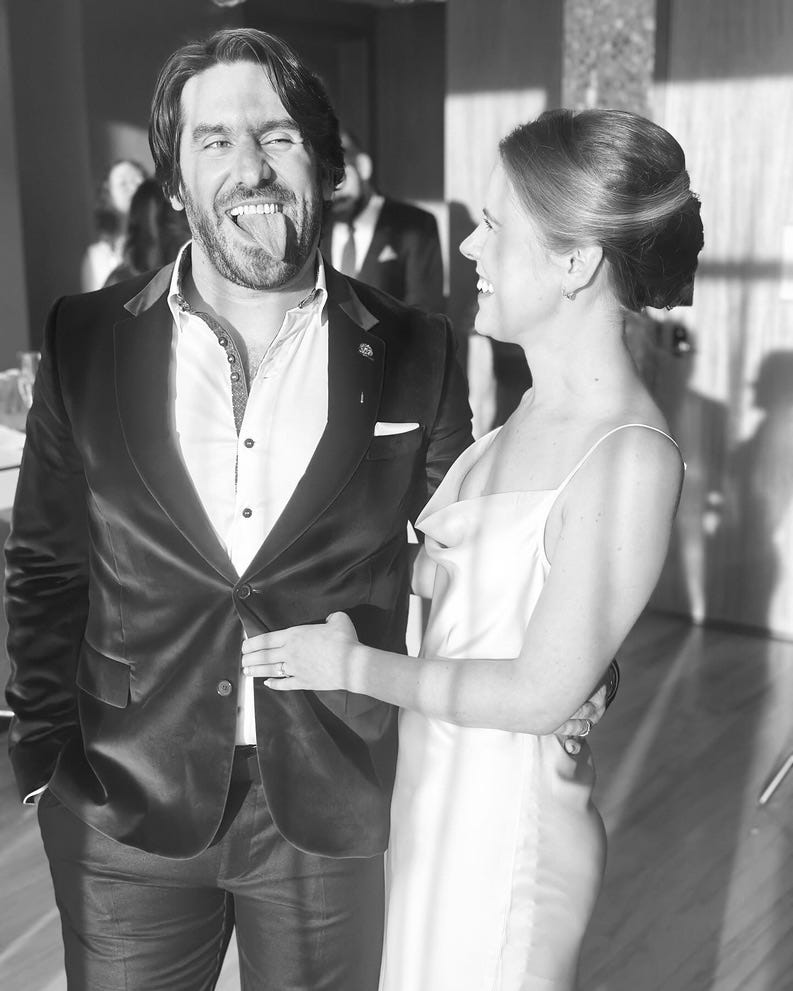

Kevin and I had a blast celebrating Jonathan and Regan’s wedding in Las Vegas!

Jonathan & Regan — married October 12, 2023

November

The Christmas lights went up at our house before the first snow!

Nuggets basketball season started — and of course I cheered for the Warriors with my gold nails, which ChatGPT designed and my tail tech made real!

First snow, up at Red Rocks with Dagny for my final dry-ish hike of the year.

December

Achieved an angel investing milestone: $1 million of my own money deployed in companies and funds since I started doing deals on my own in 2012.

Hood River for Christmas! The first celebration without Angela was sad at times, but I also found comfort in seeing how resilient kids are. We stayed at Skamania Lodge on the Columbia River Gorge, and wow the Pacific Northwest is pretty.

January ‘24

Stepping into the new year, my cofounder and I made a switch in roles and I moved from CTO to CEO of Groupthink. This decision deserves a much longer post. I spent a lot of time in Arizona working on our roadmap and transition.

our favorite place to co-work? Fox’s Cigar Bar in Scottsdale Frugality has been on my mind with more international travel and big plans for home improvements on the horizon, and one area I knew we could do better was our monthly food spend. Two people really don’t need to spend $3,000/month between groceries and eating out — even when food is my major hobby.

smoking brisket in the dark To save money and improve nutrition, I upped my meal planning and prep game, with daily mis en place in the late afternoon and much more attractive container game for leftovers. I’m re-visiting my whole view on leftovers, and trying to get more green on the plate and experiment with plant-based and vegan recipes.

homemade pad thai

smoked lamb roast with red wine reduction

using cilantro from our hydroponic garden February ‘24

Hawaii for my annual trip with my parents! My Dad was waiting on a knee surgery (successfully completed with no complications last Friday) so we had a very laid back time in Kauai, and I stayed behind for a few days after everyone else left to write and think and work on my CEO transition in peace.

March ‘24

Celebrated the elopement of friends with a fancy, and I loved my new dress!

Dress: Sachin & Babi, Shoes: Manolo Blahnik Then it was off to San Francisco to hack on an Apple Vision Pro app prototype and catch up with old friends! A packed social scheduled meant reunion meals and drinks at old favorites like Cotogna, Local Kitchen, Burma Love, As Quoted, Coqueta, Shotwell’s, Plow, Senor Sisig, Zuni Cafe and Saison and new spots like Early to Rise, Dalida, Pacific Cocktail Haven, and Copra.

Even “casual” food feels a bit more special. There is a lot of pride in the food culture here, and it shows. In the land of move fast and break things, his perspective on craft, quality, and excellence is refreshing.

Breaking bread, telling the long versions of stories with lots of eye contact, holding space for the anxiety of big news (a birth! a death! an engagement! a divorce! a loss! a breakthrough!) and never quite being the right temperature but dealing with it because you’re just so happy to be here.

after the lock-in at Shotwell’s with the old crew The same parts of San Francisco that were gross and dangerous when I moved there in 2009 are still like that. The locals avoid 6th Street (drugs) and Union Square (tourists). It smells like eucalyptus and sounds like parrots in the morning.

Onward!

-

Little Drops of Happiness

Summer is winding down, kids are going back to school, and we’ve reached the point of the year where I don’t have to use central AC. I love summer but it has been HOT, and I’m ready to for the short window of “autumn” that usually turns to frosty mornings after just a few weeks here in Colorado. As I type this in a sundress on the patio, under the dappled late afternoon light of my redbud tree, this feels like a good time for savoring the daylight, bare feet, and lack of layers.

On the Road

After leaving Telluride last week, Kevin and I decided on a whim to drive a few hours West to drive the Lamborghini in the canyons there. She just hit 15K miles!

Last year on a roadtrip to Utah we randomly discovered Gateway Canyons Resort(and its part of the Amex fine hotels + resorts program!) and it’s the most incredible middle-of-nowhere adventure travel stay. It was created by John Hendricks, the founder of Discovery Channel, and sits at the confluence of 5 different canyons so the views are mind blowing. And just like last time, we had the place almost entirely to ourselves.

Sometimes I feel like travel is just a constant search for new places to sit and read, and the patio of our suite (thanks for the upgrade Noble House!) didn’t disappoint. Despite being one of perhaps 4 couples on the property, the food program was just as spectacular as last time.

Wild boar adovada tacos + prickly pear margarita Over the holiday weekend we drove 2 hours West from Denver to the Continental Divide to visit our friends in Granby and hike their land, which backs up against the Granby Ranch Ski Resort. It was pretty cool to discover I could actually do the hike in decent time. I was still winded and sweaty, but lugging 50 fewer pounds felt great and I was able to pass on the offer to ride in the UTV. We brought Emo and Taco along, and I even got to break in a new pair of hiking boots!

We made it back down to the house just in time for an afternoon thunderstorm to let loose with hail, wind, and some huge lighting bolts across the valley. Meanwhile, we were cozy inside with our reward: seasonal beers and bowls full of sliced Palisade peaches and pluots topped with freshly made whipped cream.

Around the House

It feels strange to be thinking about my winterization checklist when its still hitting 90 degrees most days, but here we are. Right now it’s all about the gardens, including building the fence and making plans to grade the lot next door and harvesting my raised beds.

Our portion of the fence construction is done… next door is underway now Based on lessons learned, I’m making plans for the switch back to hydroponics (let me know if you’d like the Google Doc describing my setup!) for the colder months and I think that’s going to be my main source of lettuce and herbs going forward. It’s just too hot outside. I’m also planning to grow cutting flowers so I can have some fresh color and sparkle indoors during the darkest months.

Roma tomatoes, cherry tomatoes and jalapeños I grew in my raised beds Lesson learned (again!) to start my seedlings earlier than I think I should so they can be bigger and heartier before transplanting outside. Hopefully I’ll harvest a small number of peppers from these plants before the first frost, or maybe keep them going in my atrium, but its nowhere near what they could have been.

Marigolds and jalapeños grown from seeds I germinated back in February Inner Life

Body

As my health transformation continues, I’m coming to terms with the logistical impact of dropping several dress sizes and I’ve been rotating my clothes, trying stuff on, and gave away 13 BAGS of stuff that just doesn’t fit anymore. I’m also on a mission to start running 5 miles every morning in under 60 minutes, but right now I am only testing that distance 1-2x per week and my current PR is 73:01. Combine that with neighbor Pilates and barre classes plus weight lifting in our home gym, and I’m pretty sure I’ll be unloading a lot more clothes come spring!

Another huge win is the reduction of my tinnitus as a result of better posture, thanks to Pilates, and the resolution of my cross bite thanks to Invisalign. The ringing in my left ear isn’t completely gone, but falling asleep is a lot easier. This week I’m getting masseter muscle Botox to relax my jaw and allow the muscle to reduce, which should help with my clenching and restore some symmetry, too.

Mind

My break from social media continues, and I took my Twitter account private right after my previous post because I was just feeling raw from the grief and could not deal with random interactions there anymore. Honestly, I’m grieving Twitter too — it was a huge part of my social life and career success, but now I’ve followed too many random weird accounts and I am actively purging daily. Ugh! I think going private was more than I needed to do, but I didn’t really notice a meaningful change in impressions on my posts so I’m going to leave it like that.

I’ve been reflecting a bit on what I’m looking for out of sharing my life online, and after blogging for so long (20 years!) I have to admit just keeping up the habit ranks somewhere on the list. I’m not sure how often I’ll be blogging, but I’m enjoying it for now so I’m going to see if a weekly cadence could work for me. After getting some kind emails in response to last week’s update, including encouragement to keep writing and sharing pictures and slice-of-life updates, I see another benefit in just being able to stay connected to wonderful people I’ve met over the years who are scattered to all corners of the Earth. Hello out there!

P.S. My SUV Blue Betty was “the mule” for the trip, and while she’s no supercar we did manage to get some great glamour shots. She’s going up on Turo for the winter. Email me or drop a note in the comments if you’ll be heading to Colorado and want to rent her!

-

Soul Cartography

Hello from Telluride, Colorado — possibly one of the most beautiful places on Earth. August is my favorite month! I’m here with my cofounder Jonathan to celebrate 2 years of our startup (8/18) and my husband Kevin to celebrate 16 years of marriage (8/25). They’re off driving the Lamborghini on the Million Dollar Highway this morning as I write this.

It’s been an exciting, tumultuous, fascinating almost-year since my last post. I’ve managed to lose 50 pounds through intermittent fasting (30 since my last post!), pivot our startup and launch something new, make a major iteration on my urban garden, embark on meaningful new personal relationships, and take several awesome trips.

Sitting here on a quiet mountain morning watching hummingbirds feed as the mist clears, I find myself caught between gratitude and heartache. I’m reflecting on how far I’ve come and how much better I know myself and what I want, while also grieving unfulfilled hopes and needs and wants. Welcome to the human race.

Beyond the highlight reel, I’m sitting with heavier emotions that seem incongruous with the sunny days that mark the best time of year to live in the Mountain West. These days I exist in a state of defrag at the intersection of creative breakthroughs, ineffable truths, hard decisions, and tragic losses.

A Hard Decision

My cofounder and I took a long walk yesterday, discussing the need for storylines to give comfort and meaning and coherence to our lives, versus his more moment-to-moment way of being. Even though I know its not how life works, I still find myself fantasizing about some point where there is a sparkling coherent arc to the story of my unfolding. In a way, its a death fantasy when you consider that we really won’t know how the story turns out until it’s all over. Meanwhile, my soul is continuously shaped by everything I experience, create, find, and lose.

Kevin and I made the hard decision not to continue the process of having kids. As I work through adjusting to this decision, the task ahead of me includes a re-writing of stories I have creating around “my Family” and “my Place”. This journey is highlighting the inner tension I have felt my whole life between security and adventure, stability and progress, tradition and creativity.

When I zoom out, I’m relieved to find that I still feel deeply connected to humanity, reassured in knowing each of us is navigating the unique constellations of our inner lives. As I retire the well-worn image of a version of future me I’d become attached to, I wonder: How many times do I have to forget and remember that I don’t have to stick to any scripts, including the ones I wrote for myself?

A Tragic Loss

While I face my mortality through the lens of legacy and procreation, I’m also grieving the loss of my sister-in-law Angela, who passed away at age 50.

Angela’s death comes just ~2.5 years after the loss of my sister-in-law Jill, age 49. Both deaths were sudden, unexpected, and came far too soon. My sister Meg also suffered a scary near-death experience in a fluke accident earlier this summer, so I’m feeling the sense of fragility and mortality of relationships with my loved ones more than ever.

There are were so many wonderful things about Angela, so I’ll share just one from her obituary that made me laugh:

“When Angela was 12 she decided she wanted to meet George Lucas, the director and producer of Star Wars. Without the help of a computer or the internet, Angela was able to track down the phone number of his personal secretary and convince her to give her the address of his office. She would later find out the secretary had no idea she was 12 when they spoke, believing Angela to be an adult. After writing him a letter and making a cassette tape with a reimagined audio version of Star Wars, performed by herself and her younger siblings and with her mother providing piano accompaniment, she sent them off with high hopes. She was disappointed when all she got for her trouble was a free membership to the George Lucas fan club and an autographed picture of him with the Star Wars cast. Despite her disappointment and slight disgust with not getting to meet him, Angela kept the picture on her dresser until she moved away from home.”

I woke up in Tuesday with real tears finally, the first big cry even though the funeral was weeks ago. I cried in bed, in the shower, on the bathroom floor, while hugging a dog, and at random moments of beauty on the drive to Telluride. I’m not new to grief, but it doesn’t seem to be something that hurts less just because I’ve done it again and again. I don’t want to be numb, and I don’t know what it would mean to be “good at it” but I don’t care. So instead I just feel everything.

For me, this means staying present in my body and riding the waves of big emotions as I honor not only this loss but all the other losses that ask to be re-processed. Memories that come back so vividly, intrusively, and refuse to let me just go on with my day until they’ve been acknowledged. Pangs of future loss I experience like a memory each time I interact with a loved one. A cruel avenoir.

My heart aches most for those who are left behind as they struggle to make meaning from this tragedy and continue living. Angela is survived by 3 kids and her husband, her Mom, and her close-knit community in a town of less than 500.

Living and loving is such a risk. The temptation to close my heart and keep myself small and safe is there, and I find myself in my darkest moments repeating “stay open, stay open” like a mantra.

—

The next morning

this loon, speckled

and iridescent and with a plan

to fly home

to some hidden lake,

was dead on the shore.

I tell you this

to break your heart,

by which I mean only

that it break open and never close again

to the rest of the world.Mary Oliver “Lead”

—

Living My Ineffable Truth

There are many important parts of my life that I don’t write about online, even when I want to shout “this is so great omg!” or “holy shit that hurt!” from the mountaintop. I have a private daily hand written journal practice for that.

Unfortunately, I’ve come to see how my blog and social media accounts have fostered parasocial interactions and memetic desire.

To foster greater creativity and do less harm, I’ve stopped using Facebook and most other social media, taken my Instagram private, and deleted all my old posts on Twitter. As I get more of my needs for attention, validation, and connection met by my close relationships in the offline world I find the privacy and peace refreshing.

—

P.S. They say death makes us want to have more sex, food, and all that. Maybe that explains why I had so much fun at Brown Dog Pizza!

-

Getting the Garden In

I’m absolutely thrilled to have a garden of my own, and to get to dig around in the dirt for as long as I want without anyone telling me to come inside. Some kids become adults and buy all the candy they wish they’d had growing up, but for me it’s all about getting to refine my house (as workshop instead of museum) and land.

I’m so passionate about this project, that I cut my New York visit a day short when I read the rain had stopped in Denver. I scrambled for a last minute flight change that had me racing to LaGuardia in rush hour traffic, and flew back at night to enjoy a completely unscheduled day when I would have been traveling. It was so worth it!

The soil of my raised beds was prepped in March with some hand tilling of bone meal and fertilizer to refresh the minerals, but it was still too hard and cold to work with. I came back worried I didn’t have the tools to deal with so much compacted soil to find the worms had been hard at work, and I was able to turn over the top 12 inches using a hand trowel and spade.

Tomatoes, jalapeños, sweet peppers, bell peppers and ancho chiles These beautiful redwood planter boxes were built by friends of ours in 2019, shortly after we moved in. Across 9 boxes they offer about 80 cubic feet of growing space, and are bottomless for drainage. After a few years in the elements, they were looking dingy and warped where water had been standing, so I got an orbital sander (possibly the best thing I bought this year!) and cleaned them up and treated them with linseed oil.

Before:

After:

In late February I started seedlings, but something went wrong (I think they were a bit too neglected) because they’re still quite small.

I’ve rolled them outside to harden, but in the meantime I decided that to avoid last year’s problems (too small a harvest for how much work it was) and dropped by Home Depot for some slightly more mature plants to get things started.

From front to back: 1) lemon thyme, Italian thyme, oregano 2) a whole bed of 12 cauliflower plants 3) two planters of cherry tomatoes I’m thrilled to see my garlic ramps appear for the 3 varieties I put in before the first frost, and they’ll be ready to harvest in the fall:

Garlic, along with rhubarb that comes back every year no matter how brutal the winter My strawberries are also coming back, and I’ve loosened up the dirt so their creepers can take hold. I’ve also added 2 cucumber plants to the mix, so this doesn’t look like much but it’s going to be a total mess of vines come August.

The dogs like to dig in this one, they love to eat strawberries before I can harvest! I still have a punch list of tasks left, like setting up dripper hoses and laying down mulch to protect the soil from the hottest baking sun of summer. I have more pots to fill with the seedlings, marigolds to line the beds and protect against pests, and of course the endless cleanup, weeding, pruning and confessions of my deepest secrets (plants are great listeners) and greatest desires (and they don’t judge). But things are underway!

I’m deliciously sore, sunburned, stinky, with dirt under my nails. I feel so alive.

-

All Out of Dry Powder for the Year

Last week, Kevin and I participated in our first ever car rally with Mike Ward Automotive for their annual autumn leaves driving event in the Rockies. I feel so fortunate to join this awesome community. We enjoyed some awe-inspiring drives with stops in mountain towns including Berthoud Pass, Independence Pass, Steamboat Springs, Aspen, and Vail.

There’s a lot going on in the world, and I’m closely managing my information diet these days to strike a balance between being informed vs. being overwhelmed.

In the 30 minutes I allow myself to read the news each day, I’m following events in Ukraine/Russia, Florida, climate change, and local crime in Colorado with deep concern and compassion for human suffering. It’s really painful to read the news, and I’m starting to think more tactically about what I can do to get involved. I’ve said “I’m not political” outwardly for a long time, but I think that’s changing soon.

Everyday Dynamism is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Subscribed

Investing Thoughts

On the other hand, I’m following the mid-term elections and unwinding of a decade of money creation in the US with morbid curiosity.

Inflation

I figure since we have no choice but to live through this part of the cycle, I better learn something from it, and to better understand our last dramatic inflationary period I started reading Michael Darby’s The International Transmission of Inflation (1984) last night. We’ve come a long way from hand-building models on Mark II and Mark III computers.

I’m grateful we were able to refinance our house when rates were at their lowest, and I’m looking at our other debt exposure to make sure we’re being smart. Kevin and I got married right before the 07/08 collapse, and we’ve been reflecting on what we learned from some of the top-of-market decisions we made last time. My hope is that we can make only new mistakes. The main topic of conversation is around how much more (if any) risk to take, how to collateralize it, and whether to pause development on the land we bought next door to our house since financing for construction loans has gotten very expensive and fixed rate options are basically not a thing at all right now.

Private Companies & Funds

At least in the face of all this volatility, we’ve continued to invest in startups and funds, and achieved our goal of deploying ~5% of our net worth this year.

Me: “Are you investing?”

Him: “If we had a fund I would. I’m super illiquid rn”

Me: “just deployed remainder of my fun money for the year, so I’m in the same boat”

So what investments closed out my dry powder for the year?

This week I put up my first capital call into the latest Heavybit fund (developer tools), and invested $100K in the Series A of a space tech transportation company (join my syndicate to see the deal details and participate in the SPV I’m leading). This is my first syndicate on AngelList, and wrangling investors has provided an education in LP communication that reminds me of the Mattermark party-round days. Kicking it off als led to some inbound interest about me raising a fund.

Although I’ve raised millions on AngelList for my startups, I haven’t been very actively on the platform as an investor. Now that I’m dipping my toe in, I can see there are benefits to having regular deals happening so investors get more and more familiar with what I’m into. So far, I’ve learned that running one-off SPVs is often time-consuming because it requires continuous cultivation of LP relationships an investor brand. I’m not ready to pull the trigger on this fund business quite yet, but I’ve got a few potential partners in mind and I’m definitely factoring this into my thought process as I start to rough draft my 2023 goals.

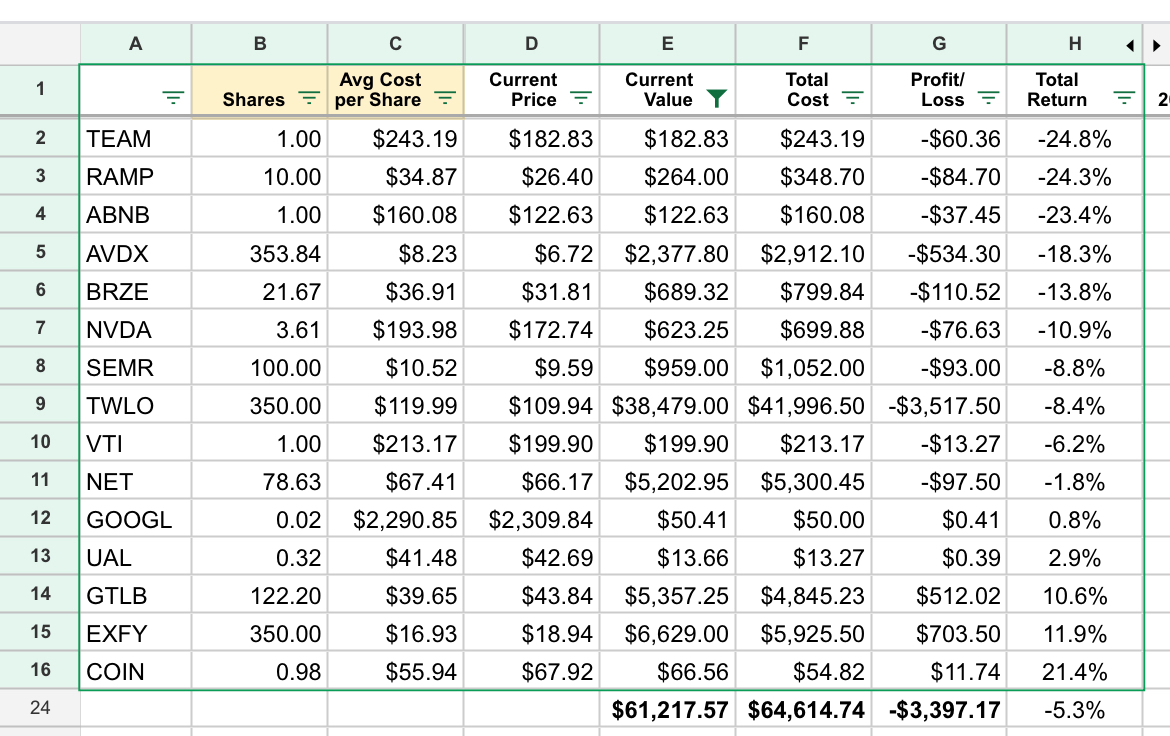

Public Companies

It’s probably time to circle back to these, but it’s been nice to have a break from tracking the market on a daily basis. I continue to hold my long concentrated positions in Twilio and GitLab, and I believe Twilio in particularly seems massively oversold (-78% in the past 12 months) while GitLab remains significantly below its IPO price. I’m looking forward to getting myself back into a position cash-flow wise where I can be a buyer in this market, but right now I am in look but don’t touch with these two and a handful of other names including Cloudflare, Palantir, Crowdstrike, Snowflake, and Porsche (why not?).

It’s a great time to read deeply and learn, but I’m not ready to transact or go back to building any kind of tracking portfolio.

Around Town in Denver

I went to my first two NFL games in Colorado, where we watched Broncos fans boo the home team… so that was interesting. It was an ugly win both games, but we got there! I’m a long way from being converted to a Broncos fan from my loyal Seahawks fandom, but it was fun to explore Mile High Stadium and I even managed to bruise my hand and lose my voice in my enthusiasm.

The view from Section 528 (Broncos vs. Texans 2022-09-18) The real highlight was getting to hang out with former Mattermark team member Karlie (3rd from right) who recently relocated to Denver from Chicago. One of the many things I love about having lived more years is how wonderful people fro one chapter of life drift back to me again in another, through the natural course of events. I’ve got my O.G. cat loving space pants SoulCycle buddy back!

Jessica, Karlie, Kevin and Me Eating Well

We’ve been enjoying the bounty of the season in our local Denver restaurants, especially fresh peaches and late season corn.

Wagyu tallow candle bread service at The Fifth String in Denver If you’re headed through Denver anytime soon, here are a few spots I recommend:

- Brunch: Bacon Social House in Sunnyside, Le Bilboquet in Cherry Creek North, Root Down in Highland, and of course Snooze (multiple locations)

- Chill Dinner: Lucina Eatery in Park Hill, The Greenwich in RiNo, Benzina in Park Hill and The Fifth String in Highland

- Fancy Dinner: The Wolf’s Tailor in Sunnyside, Restaurant Olivia in Wash(ington) Park, Bistro Barbes in Park Hill, and Beckon in RiNo

I’m pretty thrilled to see that people are reading my tweets and eating at these awesome spots!

Kevin “KMac” Damaso @project_kmac

1:58 AM ? Sep 29, 20226Likes1Retweet

All these places are amazing and you should try them. But as I write this I can see I need to branch out to different neighborhoods more often, and I’m ready to up my brunch game in particular. I’m fairly adventurous, but it’s easy to get into a pattern. If you have Denver restaurant recommendations, please add them in the comments!

I also asked for recommendations for our upcoming trip to Seattle, and I want to eat everywhere mentioned in the replies.

What I’m Reading

My Goodreads is as meticulously up-to-date as ever, and I hope you’ll join more than 700 people who follow me there for interesting updates in your books feed!

Theme: Social Status & Class

- The Protestant Establishment: Aristocracy & Caste in America by E. Digby Baltzell (1964)

- Status: Why Is It Everywhere? Why Does It Matter? by Cecilia L. Ridgeway (2019)

- Wanting: The Power of Mimetic Desire in Everyday Life by Luke Burgis (2021) who also has an excellent Substack publication

- The Status Game: On Social Position and How We Use It by Will Storr (2021)

- Virtue Signaling: Essays on Darwinian Politics and Free Speech by Geoffrey Miller (2019)

Theme: Parenting

- Good Inside: A Guide to Becoming the Parent You Want to Be by Dr. Becky Kennedy (2022)

- The Blank Slate: The Modern Denial of Human Nature by Steven Pinker (2003)

- What We Owe the Future by William MacAskill (2022)

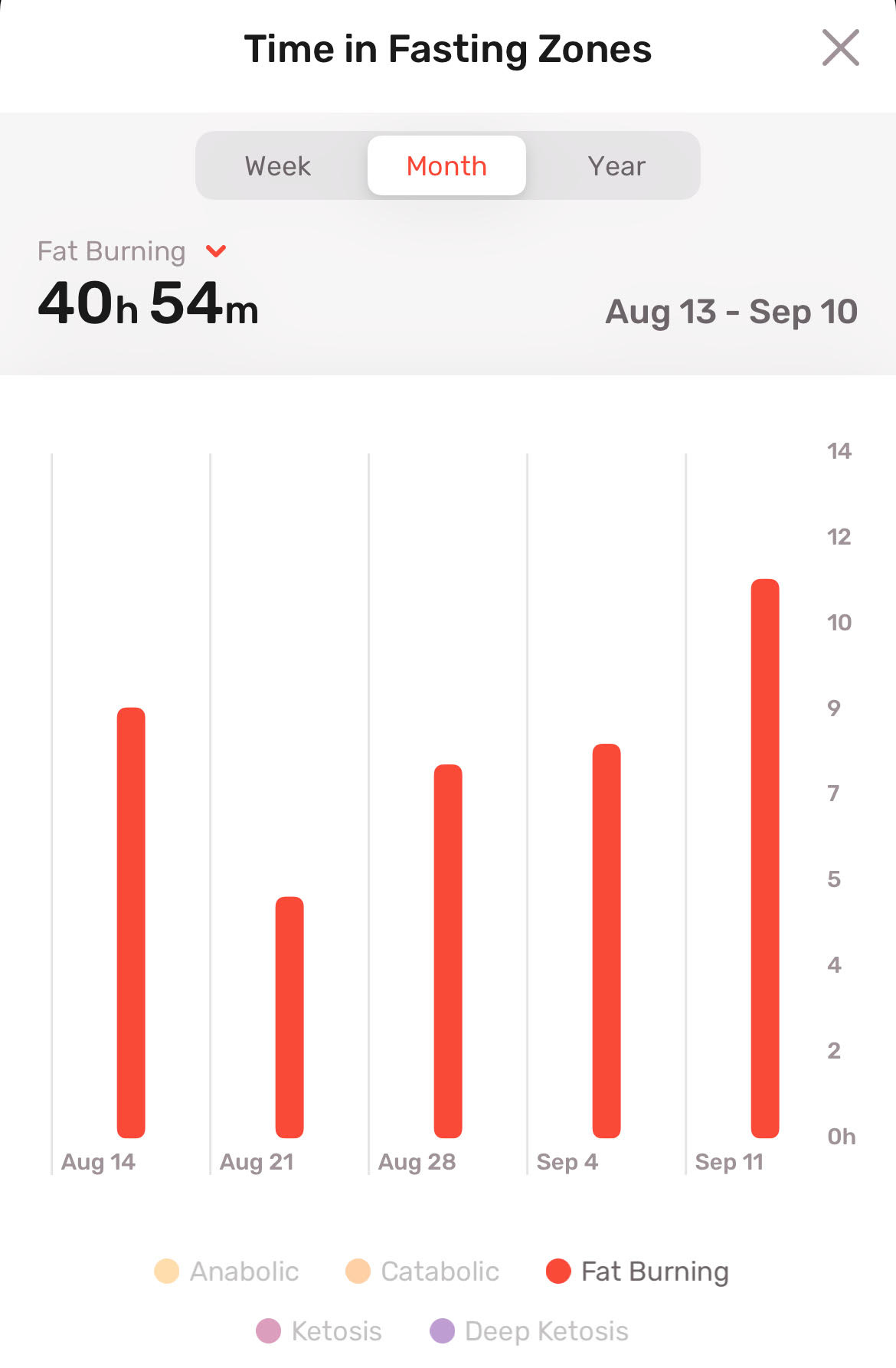

Intermittent Fasting Update

Week 5 is done! This week I logged a new PR for hours in the fat burning “zone” (between hour 16 and 24 of a fast). It feels like I’m getting the hang of this. My biggest challenge is definitely dealing with the moodiness inspired by my physical feelings of hunger in the final hours of each fast.

My goal is to achieve ~16 hours per week in this zone and sustain that, which can happen simply by sticking to a simple 18:6 schedule (18 hours fasting, followed by a 6 hour feeding window) with a couple extra fasting hours tacked on when I feel like its going well and I can stand to wait a little longer.

I haven’t yet ventured beyond a 24 hour fast yet, but now that I have the all-clear from my doctor and some guidelines around where the limits are (refuel with healthy nutrient rich foods, don’t pass out, drink a LOT of water and pee nearly clear throughout) I’m hoping to experiment with ketosis soon to get some other health benefits besides weight loss. Fortunately, I did a blood panel in August and all my biomarkers are looking good, so I can focus on making this change while I’m otherwise healthy.

In addition to intermittent fasting, I’ve enrolled in a 12-week weight management course with Forward Health and got a referral for CBT (Cognitive Behavioral Therapy) with a specialist focused specifically on this area. I am hopeful that I can make changes that are long-lasting (so that I won’t ever need to buy a new wardrobe of clothes again!), maintain good mental health along the way, and stay of the “obese” clinical category from now on (only ~5 pounds to go!) to reduce my exposure to the health risks associated with obesity.

Go Broncos!

-

Recapping Summer 2022

What a lovely break I’ve enjoyed from writing for the eyes of others. Thank you for the space. This morning I’m enjoying a break from the heat wave we’ve been having here in Denver, with temperatures down in the mid 50s. The dogs love it, and so do I!

Investing

My most active investment, my own startup Firstparty, celebrated the milestone of getting its first paying customer over the summer and we are still working on getting to product/market fit. It’s been nearly a decade since I was hands on with this phase of startup building, and it is a humbling journey and test of patience to be sure.

On the private company side, I’m working with a couple long-time startup founder friends on a frontier tech deal that we will be syndicating through an SPV on AngelList. To maintain confidentiality for the company I won’t be sharing details via this newsletter, but if you’d like to sign up to be notified when there is more information available you can join my LP network on AngelList.

Not much happened for me in the public markets over the summer, and I’m still long on my concentrated positions in Twilio and GitLab. I’m burned out my my “learning portfolio” approach to researching companies, and need to come up with something new that I find more engaging.

Leadership Coaching

I took about 6 weeks off, and I’m feeling refreshed. After a lot of reflection, I’ve realized that I was chronically underestimating how much emotional work I do as background processing (outside of session time) when I have active client engagements. To improve my recovery and boundaries, I’ve raised my rates and I’m coaching from mid-September to early December, and then taking another break. I don’t currently have open slots available, but you can reach out to me at danielle@morrillcoaching.com if you would like to get those email updates.

Travel

We did a lot of US travel by car this summer including our first visit to Amangiri in Utah and road-trips to Aspen, Glenwood Springs, and Gateway. We got back to California for the first time since early pandemic days, with a week in Napa around July 4th and a week in Monterey for Car Week.

We also made it up to Washington State (where we’re both from) to see family in Snohomish and Kingston, and attend a beautiful wedding in Friday Harbor.

We’ll probably have 5-6 more 90+ degree days here in Denver before we head into what is usually a fairly short but very beautiful Autumn, so I’m looking forward to several days of mountain town exploring and fall leaves peeping drives.

Health

I continue to be less of a try-hard when it comes to my goals for the year. In fact, I’m pretty sure I’m on pace to miss all of them except for the health ones. I’ve gotten into intermittent fasting and I’m averaging ~2 lbs. a week of weight loss. If I could end this year back at what I weighed right before the pandemic began, that would be amazing. As to the rest, I’m just focused on making little bits of progress every day. We found out Kevin’s vasectomy reversal didn’t work, so we’re still deciding what our next moves are there and getting more curious about both surrogacy and adoption (reading list to come in a future update).

Around the House

Day-to-day life has been pretty sweet since I last wrote to you in May, with lots of growing, cooking, and eating of my garden vegetables. I’m thinking we probably have 2-3 more weeks of growing season and then it will be time to harvest and preserve whatever we haven’t already eaten. I’m planning to make a lot of salsa.

We now have preliminary designs for the pool house, and received our permit to remove the house that is currently on the land. Demo begins on Tuesday!

Life Improvement Moves

- Sold my learning portfolio so I could stop checking Robinhood

- Set up Sanebox to digest my emails for processing 3x per week

- Removed all apps from my phone’s home screen and made it grayscale

- Hired a personal assistant to help me with life chores I procrastinate on

- Bought an Eightsleep mattress cover to improve my sleep quality (if use my link you’ll get $200 off if you buy a mattress or mattress cover)

- Started intermittent fasting with the Zero app

- Signed up for a primary care provider through Forward

- Set up Jumbo Security to archive my tweets and monitor for password leaks

Ah, Fall. I can almost smell the fresh pencil shavings (do kids even use No 2 pencils anymore?) and after this final heat wave passes in Denver, I’m looking forward to cozy sweaters and mountain drives to see the changing autumn colors.

A quick note on communicate channels: I’ve stopped using Facebook and Instagram. If you are one of the people I unfriended, please know it’s not personal. After trying some half-measures, it was the only effective way to stop wasting so much time perusing and performing. You can still find me through this newsletter and on Twitter.

-

Nesting, Idling, Thriving

Sometimes y’all get too damn serious… let’s play!

We spent the past week and a half in Bozeman, Montana supporting dear friends as they make a major life move to buy a homestead there. You can see Emo and Taco loved it!

Checking in on 2022 Goals

I added a couple new coaching clients while on the trip and have achieved my 2022 goal of billing $10K/month for that business. Rather than fast forwarding to set a 2023 goal, I’ve decided to stop striving around growing Morrill Coaching LLC for a bit and just settle into these new client relationships.

My focus now is on:

- Baby making (quite fun!)

- Product/Market fit for Firstparty (quite challenging!)

- Baseline health (10K steps, 8+ hours of sleep, eating plants)

It’s funny, now that we can conceive I’m feeling a lot less urgency about it. Anyone else have that experience?

I turned 37 a few weeks ago, and I’d be lying if I said I felt the tick of a biological clock. I don’t feel it. I just feel really peaceful in my marriage and home life, and if we add a baby to the mix I know it will be an awesome adventure. And if we don’t, that’s okay too. I will just have to get more dogs.

In terms of other people’s timelines, Kevin just turned 44, and I think he is a little more aware of what it will mean to be an “old Dad” since he had one. He’s fit and healthy as a horse now, but the fact is he will be in his mid-60s by the time our kids graduate high school. There are also my parents, who are in their mid-60s now and hopefully will live for a long long time to come. They just want more grandkids, and who can blame them? Our kids will already be the youngest among 5 other cousins ranging age 14 to 2, and unless my little sister decides to have more I am probably going to be the last one in this generation having kiddos.

Kevin and I are celebrating 15 years of marriage in August, and I feel peaceful.

Nesting Much?

I am excited to share that we bought the house next door to ours in Denver!

We’re working with the original architect and builder of our house (which was constructed in 2005) to turn the lot into a pool, patio, garden, and guest house. I find it calming having our home as our central shared project during all this chaotic market noise, and it makes it easy to be long on all our other investments. I feel fortunate that we found a diversification move that is so life enriching.

Kevin has agreed to take the lead on project management, and I’m sure you’ll see some house updates (and I’m sure some dark humor about budgets and plans and all that) in the coming months. For now, we’re in the queue with the city of Denver for permits and demolition is the next step. I’m thinking about how we can take some brick from the original house and set it aside to build the pizza oven or something else, as small nod to the past.

Market What How Now?

Emotionally, I’m barely noticing the shock waves from the financial markets. Maybe it’s because I never internalized the massive run up of the past few years as real gains? I just updated my “CFO of the household” spreadsheet, and it was pretty wild to plug in a number ~75% lower than in late December for my stock holdings account balance.

As most of you already know, I have two heavily concentrated positions in Twilio and GitLab that come from my time working for these two companies. I’ve come to realize that the way I hold startup stock in my mind is different, and perhaps something that others would benefit from knowing about. I look at it as rainy day upside, not as compensation and not as “real” money until I sell. Even though it is liquid post-IPO I still look at is as an option, and in the case of Twilio where proceeds are QSBS qualified I am even more circumspect. As those who are Super Following me on Twitter know, I’ve been buying more of both.

Here’s the latest result of my learning portfolio as of Friday’s close:

Kevin and I drove back to Denver from a visit with friends in Bozeman, Montana on Wednesday and during that 700 mile trek we had to time talk over things a bit re: the market. “I’m thinking through what’s the truly worst case scenario for us,” I told him, “To really be in trouble, we’d have to be fundamentally wrong about software and what it can do for the world.” Obviously there are some other geopolitical SHTF scenarios that are also worst case, but that’s on the downside. On the upside, my theory is that power law value creation in the future will come primarily from psychological goods rather than physical goods (bits vs. atoms).

I see no evidence this is fundamentally breaking. If anything, we are still in the early innings. For those who want to increase their own conviction, I highly recommend reading Future Shock and Revolutionary Wealth by Alvin Toffler

I also “initiated research” (sounds so official doesn’t it?) on a number of companies, which means I bought 1 share and I am planning to read a lot more about them, write up an exec summary, and decide if I want to build a bigger position in the coming months/years:

Thinking Like a Gardener

I’ve been cultivating seedlings since March, and yesterday I started planting them. Of course, I managed to dump a whole tray of marigolds onto the ground and exclaimed reflexively “No, my babies!”

Most of them were fine, and I got them in the ground. Plants are surprisingly resilient, even when they’re tiny. However, this morning I went out to survey how the peppers I put in did overnight, and its clear there are several that have shriveled up and are not going to make it. Experienced gardeners know transplanting is traumatic, and we product more seedlings than we need because we’ll be removing dead plants and subbing in new ones until everything takes.

I feel the sunk cost of the months of cultivating when tossing the tiny plant remains into the compost with a silent Marie Kondo style “thank you”.

I do worry whether there are people suffering in silence, because despite all the bravado to “fail fast” its still quite taboo to be open about losses and failures. When things go badly, the message among the startup and crypto set seems to be caveat emptor. Toughen up kid. I had to take a significant break from Twitter with the most recent crypto swirl, as there is too much grave dancing for my taste.

This weekend, I encourage you all to think about how you can spread the message of long-term thinking, cultivation, and agency. As my friend, investor, and investing partner Chip Hazard shares — thinking like a gardener is called for.

Read the full Twitter thread here.

Some thoughts while gardening this weekend and seeing this grim chart and stats. I was a venture investor across both major corrections, which were quite different. ???? https://t.co/rbzVV3kaY56:37 PM ? May 13, 20225Likes1Retweet

What I’m Reading Lately

- Virtue Hoarder: The Case Against the Professional Management Class by Catherine Liu

- The Ruthless Elimination of Hurry by John Ortberg

- The Arc by Tory Henwood Hoen

- Complexity: The Emerging Science at the Edge of Order and Chaos by M. Mitchell Waldrop

- Independent People by Halldor Laxness

- Start Where You Are by Pema Chodron

- The Ruthless Elimination of Hurry by John Mark Comer

- Work Clean by Dan Charnas

- The Burnout Society by Byung-Chul Han

I’ve been on a tear with reading, thanks to an incredible deluge of high quality recommendations from my Twitter followers. To get a taste of that they provided in response to my prompts, check out these threads…

Elle Morrill ???? ? @DanielleMorrill

What is the most transformative and/or useful book on being a good Christian? aside from the Bible of course5:22 PM ? May 14, 202221Likes2Retweets

Elle Morrill ???? ? @DanielleMorrill

What is the best book you’ve ever read concerning dignity?5:16 PM ? May 14, 202213Likes1Retweet

As always, I’d love to hear your recommendations on these prompts and anything else you think would tickle my noggin’

Have a great week everyone!