Hunter Walk & Satya Patel Close Raising $35M for Homebrew Ventures First Fund

It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two

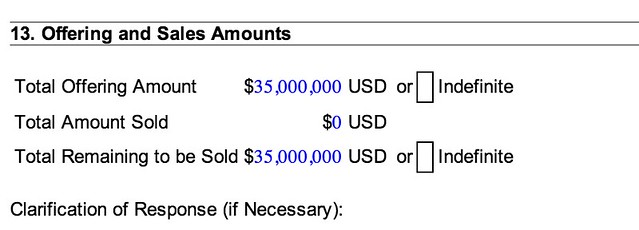

It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two have closed are raising and additional $10M, bringing the total to $35M according to their Form D filing posted on Friday.

Hunter Walk was formerly a product manager for YouTube at Google, and has been an angel investor for awhile now with investments in Schematic Labs, GreenGoose, Karma, Seesaw, Lever, Tugboat Yards, and Path 101 according to his AngelList profile. He also has a profile for his infant daughter on the site but notes he “will not be entertaining M&A offers until she’s at least 18”.

Satya Patel was formerly VP of product at Twitter and is also ex-Google and ex-Battery Ventures where he was a partner, so I am going to guess he brings a bit more of the post-investment VC know-how to the partnership. He is also an active angel investor with investments in Viddy, Wealthfront, STELLAService, BoostCTR, Clever, DNA Games, Blockboard, Adku, AdNectar, Loosecubes, BlueKai, eduFire, YieldMo, Safetyweb, ProsperWorks, Adisn, Umami, Brightedge, J.hilburn, FashionStake, and Slime Sandwich.

Both have been added to the List of Popular VC & Angel Blogs.

Image credit: Giant Fire Breathing Robot

Correction, I originally said they’ve closed the round but the filing actually indicates $0 raised so far, with the option to take up to $35M.

While they’ve probably got some soft commitments (these filings are generally a lagging indicator), no word yet on the fund being closed and ready to start making investments. The founders are also unable to discuss current fundraising activity public due to SEC regulations that don’t allow public solicitation for private investment by the company. The good news: if you’re an accredited investor you might still be able to invest. The fact that they’ve set a total raise amount that is higher than originally announced might indicate prospects for raising are looking good. Time will tell. (HT: Ryan Lawler)

7 Comments

Ryan Lawler

Total amount sold: $0

Total amount remaining to be sold: $35,000,000

They haven’t closed.

Pingback:

Pingback:

Pingback:

Pingback:

Pingback:

Pingback: