-

Embracing the Incrementality Mentality

We’ve all heard that line about the 10 year “overnight” successes.

A friend* recently told me a key metric of his company was growing 4% week-over-week. Actually, he related with some dismay that it was only growing at 4%, and he was looking to build another product to make their company more attractive for raising the next round of funding.

I was shocked.

The base number that this 4% growth is accumulating on top of is in the billions, without much marketing or distribution yet. They found a problem many people had, solved it elegantly, and then forgot to tell those people about it.

Instead of doubling down on something that was working, going big and blowing it out of the water, they went chasing after another adjacent product without real market validation, significant platform risk, and delusions of grandeur. All to raise a Series A.

I’ve seen this story play out before, and it doesn’t end well.

Double Digit Growth Addiction

Paul Graham’s essay on Growth is extremely important reading for early stage startup founders, and this guideline in particular is quite useful:

A good growth rate during YC is 5-7% a week. If you can hit 10% a week you’re doing exceptionally well. If you can only manage 1%, it’s a sign you haven’t yet figured out what you’re doing.

Important context for this advice, which I believe is often missed, is that the majority of companies in YC launch during the tail end of the program.

If your startup has some success in the years following graduation from the incubator, you’ll discover the painful truth: it’s incredibly difficult to grow 10% week-over-week once your TechCrunch spike is gone, you’re 3 months out from demo day, and you’re still not doing marketing because [enter excuse here].

Gone are the days of the lovely hockey stick graph you proudly showed investors from the Demo Day stage. It’s been six months now and their money is in the bank, but the rush of winning those signatures has long passed. You feel like every update you send them is a bit anti-climatic. “Grew 14% this month,” you write, and paste in a graph with bars as blue as you feel.

The 6 Month Crisis

For startups who are funded, it’s easy for founders to tell themselves that fundraising isn’t the most important thing but a lot harder to feel it, know it, and truly believe it. Often raising a round is the first external-facing “win” you’ve experienced in months. It becomes a new emotional local maximum, and six months after raising you might find yourself looking for the next burst of excitement and validation to match it.

Long gone are the double digit numbers, because the base you’re growing from is much bigger now. You can’t hand crank this machine you’ve built anymore. You need people to help you feed it. There aren’t enough hours in the day. You’re a generalist but now you need specialists.

Things have changed, and that’s okay.

Building a company is quite different from starting one. The shine of being a “startup” wears off, and it’s time to be a business. As soon as you’ve found some product market fit your job shifts from finding the market to capturing it. If you don’t make this mental switch, and keep fighting for the new hotness, you’ll be like so many companies with too many ideas and too little execution. You’ll die.

Incrementality

Most wins you’ll have are incremental, so subtle that you might not even realize you’re winning. When seasoned CEOs say the harder road lies ahead as you toast champagne to a milestone like a financing round closed, big contract signed, crucial hire started, key acquisition completed etc… they know the truth.

All that vision, all that ambition, all those grand dreams of the future… they felt so close as you pitched your big vision but as you wallow in the weeds and details of really nailing each sales call, each deployment, each planning session, each new hire… all that feels so far away. In some ways, you might feel held back.

It’s so tempting to dabble. Now that you have money in the bank, a team around you, and some traction you feel you could build anything. You can see your market more clearly than anyone else on Earth, and you’re intimately aware of the problems your customers face. You want to solve all of them. You want to be their hero.

Just stop.

Your ego is going to hate you for this, and it will fight you.

Stop.

The Longest Road

Building a startup is about fighting all the temptation that lies out there for a maker. You can prototype anything, maybe you also have some visibility and platform to speak from, it’s easy to think you can dabble in anything that could be a big market opportunity. The “Crossing the Chasm” strategy of tackling and winning a beach-head, which sounded so right and so daunting 6 months ago, is now happening. You haven’t won yet but like a soldier who yearns for home you’re looking to the future and, if you allow it, that distraction can become so acute you’ll die in a daze on the battlefield. You might not even know you’re dead.

Investors, advisors and other people will also start seeing the future more clearly – because you did a great job painting the picture for them. They’ll try to get you to talk about what’s next, they’ll add more temptation to focus on the next battle when you haven’t yet won this one.

Don’t let them.

Win.

*details have been changed to protect the anonymous

-

The $3B+ Exit Tumblr Could Have Had

It’s all over the news, Yahoo! is in talks to acquire Tumblr. The popular blogging platform, which was founded in New York in 2007, has just a few months of cash left and hasn’t successfully monetized their platform fast enough to cover costs.

It’s all over the news, Yahoo! is in talks to acquire Tumblr. The popular blogging platform, which was founded in New York in 2007, has just a few months of cash left and hasn’t successfully monetized their platform fast enough to cover costs.

To date investors have put $125M into the company, most recently infusing it with $85M more in September 2011 at a valuation of over $800M.

According to Forbes Tumblr is targeting $100M revenue in 2013 but, according to sources I spoke to who are familiar with the company, actual Q1 revenue growth was flat and Tumblr is on track to do only $15M in revenue this year.The company started selling ads in May 2012 and revenue was reported at $13M for the year. Tumblr’s source of advertising revenue is the logged in user “dashboard†where sponsored posts are displayed in the sidebar via Tumblr Radar, while recommended posts are injected directly into the feed by Tumblr Spotlight..

Tumblr claims 120M+ daily impressions on Tumblr Radar, which equals 3.6B+ monthly impressions. Assuming $10 – 20 RPM (revenue per thousand impressions), which is within the normal range for premium brand advertising, the total revenue opportunity for Q1 was $108 – 216M. Based on this calculation, at an annual run rate of $15M ($3.75M quarterly revenue) Tumblr is selling 1-4% of its total monthly inventory. If you think about this operationally it sounds reasonable, as the company is just beginning to ramp its ad sales.This analysis rests on the assumption that Tumblr advertising will command premium brand advertising prices. If not, RPMs in the $3 – $9 would be more realistic and you could reduce all the values in these calculations accordingly.

Tumblr claims 120M+ daily impressions on Tumblr Radar, which equals 3.6B+ monthly impressions. Assuming $10 – 20 RPM (revenue per thousand impressions), which is within the normal range for premium brand advertising, the total revenue opportunity for Q1 was $108 – 216M. Based on this calculation, at an annual run rate of $15M ($3.75M quarterly revenue) Tumblr is selling 1-4% of its total monthly inventory. If you think about this operationally it sounds reasonable, as the company is just beginning to ramp its ad sales.This analysis rests on the assumption that Tumblr advertising will command premium brand advertising prices. If not, RPMs in the $3 – $9 would be more realistic and you could reduce all the values in these calculations accordingly.Tumblr may also be enticing early advertisers by selling inventory for a fraction of the price it eventually hopes to charge. At $1 RPM $3.75M in revenue would have paid for 30% of the available impressions, and in order to sell 100% of its inventory in Q1 Tumblr’s average RPM would have had to drop to $0.35. Compared to Reddit advertising, which offers $0.75 CPM, and sub-$1 rates for Tumblr CPMs sound plausible.

Red Flags

There were signals of a possible revenue ramp miss in the first quarter of 2013 with the resignation of Rick Webb, who was brought on board just 10 months earlier to focus on revenue growth and work closely with Tumblr CEO David Karp. He is the latest in a string of senior executive departures characterized by Beta Beat as a “leadership vaccuumâ€.

There were signals of a possible revenue ramp miss in the first quarter of 2013 with the resignation of Rick Webb, who was brought on board just 10 months earlier to focus on revenue growth and work closely with Tumblr CEO David Karp. He is the latest in a string of senior executive departures characterized by Beta Beat as a “leadership vaccuumâ€.The shutdown of Tumblr Storyboard in early April was another worrying signal. The project was touted as a “journalism experiment†but was more likely an experiment in figuring out how to work with brands to create effective content marketing on Tumblr’s advertising platform. The production value of the content and high profile editorial team likely cost the company millions but ultimately it “didn’t work†according to Karp.

The Initial Offer

The initial offer from Yahoo! is $1.1B in cash, but according to TechCrunch it may not be accepted:

“Tumblr employees feel that Yahoo’s $1.1 billion offer is “too low†and view it as “only a first offer,†according to sources close to acquisition talks.” – TechCrunch

Employees’ opinions aside, the lack of cash on hand and lack of trust in leadership to hit revenue milestones are likely having a negative impact on Tumblr’s negotiating position, which is probably contributing to what some consider a “lowball” offer.

When it comes to setting the price, rumors that and Facebook and Microsoft are waiting in the wings to make an offer could produce a competitive bidding situation that will make up for the valuation gap left behind by questionable business results.Setting the Purchase Price

In an acquisition the purchase the price is usually set as a multiple of existing revenue or expected near-term revenue. For media companies a 10x multiple on revenue is quite steep Edit: but does happen (AOL paid $315M for Huffington Post, which exited with $30M in revenue), and with only $15M of revenue in 2013 that would put a Tumblr acquisition price tag at just $150M.

In an acquisition the purchase the price is usually set as a multiple of existing revenue or expected near-term revenue. For media companies a 10x multiple on revenue is quite steep Edit: but does happen (AOL paid $315M for Huffington Post, which exited with $30M in revenue), and with only $15M of revenue in 2013 that would put a Tumblr acquisition price tag at just $150M. My first reaction was that Yahoo! or whoever else was involved in the acquisition talks was about to massively over pay. But Yahoo! isn’t stupid, so what’s going on here? Clearly this is about expected value, not actual revenue. If Tumblr were to hit their own stated $100M revenue target a 10x outcome would be $1B – but employees are saying this is a lowball offer. Why?

Looking at our numbers from earlier, at $10 – 20 RPM and 3.6B dashboard impressions a month (and growing) the annual revenue potential for Tumblr ranges $432M – $1.44B.

Viewing the $1.1B offer from Yahoo! through this lense, it is 2.5 multiple of the low end of the expected revenue range. An acquisition at the high end of the range with a 2.5x multiplier would be $3.6B, and realistically if the company was crushing it on ad sales the multiple could be even higher.Why sell a company with such a substantial revenue opportunity on the low end of the range?

Pencils Down, Time’s Up

While employees hold onto the hope that the company will be valued on it’s ability to drive billions in revenue, the reality is that Tumblr didn’t pull it off in time. The vast majority of that potential was not realized in time.

While employees hold onto the hope that the company will be valued on it’s ability to drive billions in revenue, the reality is that Tumblr didn’t pull it off in time. The vast majority of that potential was not realized in time.It wouldn’t be a problem that Tumblr is lagging in revenue production if the board felt the odds of the company capturing this expected value were good, and that was probably the thinking when they invested $85M in 2011.

Two years later it looks like the CEO who famously quipped to the L.A. Times “we’re pretty opposed to advertising, it really turns our stomachs” may have hesitated to monetize too long, and investor patience seems to have run out.The path to keep the company independent would probably involve finding a replacement CEO, or at the very least hiring a COO to be Tumblr’s own version of Sheryl Sandberg and drive the company aggressively toward revenue. It would also mean raising a boatload more cash at significant dilution to everyone involved, cutting expenses, and buckling down to operate like a serious business generating meaningful ad sales revenues in the next 18 months.

Outcomes

In choosing to sell the company and hand Tumblr over to a professional management team with a track record for monetization through media properties, the board is implying that they do not feel putting more money into the company would enable the management team to achieve a better outcome in a reasonable amount of time. Investors who participated at the $800M valuation are probably welcoming the prospect of a $1.1B exit in cash – assuming some liquidation preferences were put in place they’ll get their customary 2x-3x late stage return, and the deal won’t negatively impact their respective fund’s overall IRR.

Selling now may also allow David Karp to remain in a leadership position at Yahoo! where he can continue his work to revolutionize advertising – maybe even leading Yahoo! to a more competitive position vs. Google for brand advertising and giving them a reason to drop the underperforming partnership with Microsoft in the long term. And if things don’t work out with Karp Yahoo! doesn’t seem to have any problem firing acquired founders who no longer fit with the company’s plans.

In the end Tumblr won’t see a bigger exit because they didn’t prove they could monetize their massive traffic before time (and money) ran out.

This article was quoted in: New York Post, Valleywag, and Mashable

-

Past Performance is No Guarantee of Future Results

Past performance does not guarantee future results for startups, venture capitalists, accelerator programs, the media, individual founders, or any other part of the startup ecosystem. On the mission to see into the future, there is a tendency to over value the information and lessons of the past. With 20/20 hindsight it seems obvious that things would turn out the way they have. Cell phones? Computers? “If I had been alive back in the 1950s I so would have called that,” you say. Television? Telephone? Automobiles? “Obviously I would have been first in line to get mine!”

On the mission to see into the future, there is a tendency to over value the information and lessons of the past. With 20/20 hindsight it seems obvious that things would turn out the way they have. Cell phones? Computers? “If I had been alive back in the 1950s I so would have called that,” you say. Television? Telephone? Automobiles? “Obviously I would have been first in line to get mine!”

But would you have? Really? Massive changes in how we build things, operate our companies and think about technology have often taken place gradually, and met plenty of resistance along the way. Even visionaries miss great things all the time, just look at the Bessemer Venture Partners anti-portfolio, read Dustin Curtis’ “What a Stupid Idea” reflecting on early looks at Pinterest and Vine, or the long list of VCs who didn’t invest in Facebook early on but then made a late stage play to add the Facebook logo in their portfolio.

Echoes From the Past

Limited partners (LPs) complain that their venture capital investments haven’t had returns that were as good as in the 90s. Venture capitalists complain that companies founded today aren’t as innovative as they used to be or that valuations are higher than they used to be. And the press? Writers who have never been anything remotely close to entrepreneurs will continue to bitch about everything.

“Company ABC would never do that” – says who, Company ABC is like 4 years old? “I’m not a sales guy” – you’re a 22 year old computer science graduate, you’re not really anything yet! “Startups who tried that in the 90s totally bombed” – yeah well it is 2013 now, might be time for another go. “I wish we could invest, but founders who fit our profile have computer science degrees” – your profile is 20 years old, the Internet has gotten a lot more programmable since you were in school.

Fighting for the Future

Listening to these complaints and excuses for not doing something (e.g. changing strategy, trying sales, trying a model that previously failed, investing despite lack of founder credentials) is like hearing parents complain that the kids’ music is too loud, and rock was so much better in their day. And the worst part is that they try to dress all this up as some version of “pattern matching”, which is the one of those terms you can throw out to make people nod and stop arguing with you. One of these days I’d like to jump up from the boardroom table and shout, “screw your pattern matching, I saw the results and I don’t believe you!” just to see what happens.

Boardroom fantasies aside, people who are really great at pattern matching don’t get distracted by inessential details like what founders are wearing on 2nd street this week, what kind of parties they throw, the alma mater of the software engineering team, what Dave McClure said at a conference, or even whether the company is raising at a $5M or $12M pre-money valuation out of Y Combinator this batch. These are things that might matter for a moment in time, but quickly fade into the past. What matters most is trying to understand how a combination of past knowledge combined with present action will ultimately generate a favorable result.

Fight for the future, or get out of the way.

P.S. I’m not claiming I am some great visionary, but I’ve been placing some bets so we’ll see in 10 years or so.

Image credit: Bioepherma

-

New 500 Startups Batch Announced. Who Has the Most Momentum?

500 Startups announced the non-stealth participants in their current batch today in a TechCrunch article, and while they’ve kindly put them in alphabetical order… you probably know by now that’s not how I roll.

500 Startups announced the non-stealth participants in their current batch today in a TechCrunch article, and while they’ve kindly put them in alphabetical order… you probably know by now that’s not how I roll.I’ve been tracking many of these companies for awhile now and will certainly start tracking those I missed. It will be interesting to see how this rank and momentum scores at the beginning of the program compare to the end of the program.

Are you a future investor, employee or customer for these companies? Get on it.

My advise to the startups looking to increase their score? Every day we hustlin’ #500strong

Full Disclosure: I am a 500 Startups mentor. I haven’t written a full ethics statement for this blog but this is my rule of thumb: no free equity/options. I make investments from time to time, you can see them on my AngelList profile.

-

New York Startup Index: 500+ Companies Ranked by Momentum

This is the Startup Index series, an ongoing effort to measure the momentum of startup companies using external signals. It is calculated based on weighted factors such as web traffic, social media share of voice, inbound links, etc. I usually add some music, to make cruising a spreadsheet a little more fun. Enjoy!

The Startup Index is inspired by the Seattle 2.0 Index, which Marcelo Calbucci produced each month to create a leaderboard for local startups and it is now the basis for the Geekwire 200 in Seattle. But why stop at Seattle? There are many so many startup communities around the world, and today I’ve applied our algorithm to 533 startups from New York that we’re currently tracking. Check them out, see who’s on top and how they’ve been trending this past week, and as always let me know if there are companies I’ve missed and I’ll get them added.

-

Revenue vs. Value

I get a lot of feedback asking why the monthly startup momentum index doesn’t include revenue as a signal. There are two reasons, and the first is that most startups don’t want to provide that data to outsiders. The second is a bit counterintuitive, but stick with me and I’ll explain: revenue doesn’t actually matter for finding hot early stage startups.Startups aren’t supposed to be revenue machines right away; at first they’re designed as business model experiments.

I get a lot of feedback asking why the monthly startup momentum index doesn’t include revenue as a signal. There are two reasons, and the first is that most startups don’t want to provide that data to outsiders. The second is a bit counterintuitive, but stick with me and I’ll explain: revenue doesn’t actually matter for finding hot early stage startups.Startups aren’t supposed to be revenue machines right away; at first they’re designed as business model experiments.While revenue is a useful signal to founders, indicating they are creating something people want, it is also a lagging indicator of success. Startups who are willing to reveal revenue data publicly do so because it reflects well on them. They’re in control of their destiny and decide when and how to raise money. Investors and employees have already missed the window of massive upside that comes with getting in before the company reaches this milestone.

By the time a startup has a predictable and steadily growing revenue stream that means it has built a product and brought it to market successfully, so the risk of investing in it has gone down tremendously and so has the reward. This is why Y Combinator stands to be massively successful – they invest early enough to capture the upside of startups that haven’t figured these things out yet, and then they help them improve and de-risk the company before involving future investors. The YC model tolerates much greater uncertainty than other angel investors and in return they receive outsized gains from big wins, plus minimal losses from companies that fail.

How can we identify these pre-revenue startups with significant upside and get involved in them before this happens? I believe there are many publicly available signals that indicate how a company is doing, and I am building tools to track, measure and organize this information.Revenue First

Early revenue can be dangerously distracting for founders. Once you have some of it you want more, and without strict discipline it’s easy to optimize for immediate gratification rather than the big vision. For founders who have never made $10k a month this feels like a lot of money, especially for the young software engineers straight out of college who never even had salaries that high.

Now in order to make your graph go up and to the right you need to make $12k next month, and $14.5k the next, and $17k the month after that. And that’s just 20% growth month-over-month, which is not actually that sexy of a growth rate – after a year you should have a $87k month in revenue, giving you an annual run rate of just over $1 million. That’s a tiny business, and remember this is revenue not profit. If you run a tight ship this might be break even, but if you’re doing B2B software you probably need to hire support, sales, and lot’s of engineers. You need to raise more money.

What if this same startup, who is seeing steady but not spectacular linear revenue growth, is also fast becoming the most well known new company in its emerging space? They’re discussed on Hacker News all the time, friends have started using them, they’re clever and engaging on Twitter and I see them retweeted all the time, their company blog shows up on Techmeme once in awhile and when their CEO comes to speak at a conference he is the highlight of the event. I’m seeing them everywhere. A couple friends have gone to work there.

These signals, combined with dozens of other more subtle ones reaching me subconsciously, lend the company an air of inevitability.Be everywhere, be awesome.

Capturing Value

How much does this public awareness increase the value of the company? A lot.

As a founder, investor, or employee what matters more? $10,000 in revenue this month or the beginnings of a brand that is known and loved thousands of people and growing every day.When you see unexpected, small, or otherwise questionable companies in my latest top 20 list swallow your cynicism and dig deeper. For investors this is a list of pre-qualified leads worth reaching out to. For knowledge workers these are companies with upside opportunity if you join the team right now. For founders, this is acknowledgement of the hard work you’re putting in pre-revenue to build a massively valuable company.

Don’t let revenue be your vanity metric.

-

Startup Index: Y Combinator Companies Have More Than 2x the Momentum of 500 Startups, 3x Techstars

How to Read the Startup Momentum Index

Momentum measures a quantity of motion, measured as a product of its mass and velocity. In case we want to measure the momentum of a startup (the “bodyâ€) where mass is the company’s share of web traffic (as measured by Alexa rank) and velocity is the growth trajectory of several different signals (social, inbound links, page rank, etc). It is weighted toward sustained growth, versus small spurts of growth from press coverage or a burst of paid traffic or Twitter/Facebook followers. Larger companies (by traffic) who see a decline in growth across these signals will be the hardest hit, so the worst place to be on this list is in the approaching 0 momentum points.Earlier this week we released the April 2013 Startup Index, which tracks over 1,000 companies in the investor portfolios we’ve indexed with at least 4 weeks of data. Now let’s take a look at the 3 most talked about early stage investment programs and compare the momentum of their portfolio companies.

While the percentage of active companies in each portfolios differs by just a few percentage points, the total momentum points vary widely. For example the top 500 Startups company Virool (which is was also part of YC S12) has 27.69 momentum points in April, but in the YC portfolio there are 10 companies which have more momentum than this. Similarly the top TechStars company Digital Ocean has 18 momentum points, but 500 startups has 5 companies with more momentum in this and Y Combinator has 17 that rank higher.

On average Y Combinator companies had 2.4x greater momentum than 500 Startups and 3.1x greater momentum than Techstars companies in April.These differences seem to line up with differing investment philosophies. While Paul Graham of Y Combinator is focused on “Black Swan Farming” for the one home run company in each batch, Dave McClure of 500 Startups is building a portfolio around companies hitting solid singles and doubles, while Techstars takes a geographically diversified approach. As we continue to collect data it will be interesting to see if greater momentum results in more exits.

April Startup Moment Index: Y Combinator, 500 Startups & Tech Stars

Full Disclosure: both Y Combinator and 500 Startups are investors in Referly, where I am founder and CEO.

Photo credit: New York Daily News

-

Thoughts On YC Interview Prep

Companies currently interviewing for Y Combinator have taken the Internet’s advice to reach out to alumni to practice before they present, but unfortunately we don’t scale very well. I’ve prepped with a dozen teams so far and will probably talk to a dozen more before the weekend ends, but that will hardly scratch the surface. I am asking them all the same questions, so I thought I’d sum it up here for people I won’t have time to chat with.

My phone number is 425-698-7497. Call me for a 10 minute prep session. If I don’t answer just try again (or you could build a Twilio app to keep trying me, just sayin’). I won’t promise to return voicemails or texts – imagine I’m one of those people in the 90s with a landline phone and no voicemail machine who says, “if it was important they’ll call back”.

Rule #0: Read the Official Y Combinator “How to Prepare for the Interview” Guide

The Conversation

At the end of the interview, which is quite short, the people you’ve spoken to should know what you’re making (ideally because you actually showed it to them), believe you are the best team to make it, and think you are rational/determined/resourceful enough that if it doesn’t work out you’ll figure ouut what to do next.

“There’s one type of question your practice investors probably won’t ask, and we probably will: whether you’ve considered various mutations of your idea. We spend all our time dealing with startup ideas, so we’ll often see potential variations of yours that might be interesting. Your idea is almost certain to change as you work on your startup, and while it’s not necessarily going to change into something that comes up in the interview (though it has happened), we’re very interested to see how good you are at traversing idea space.” – Official YC Interview Prep Guide

Here are my 5 bullet points for this blog post

- Write down 3 to 5 key points you want to be sure to communicate

- Walk in ready to present the most important information first

- If you have a product, walk in with laptop in hand and show it

- Answer questions quickly using as few words as possible

- Make sure you bring the conversation back to cover your key points

Practice with people who are critical of you, your idea, and the way you present your ideas. When you prep helpers become yes men, giving you a metaphorical pat on the head, it’s time to dismiss them and move on.

The Demo

You should practice your demo as much as you practice answering questions. Practice walking in, open laptop in hand, placing it on the table and immediately showing what you’ve made so far. Do whatever you have to do to make this a smooth process… if you product is half done have all the important pages open in different tabs already. Be logged in. Have plenty of battery life, and make sure you’re connected to YC wifi.

The reason we like demos so much is that they reduce the amount of guessing we have to do. A startup needs to have (a) good ideas (b) implemented energetically. And while it’s fairly easy to tell from talking to someone how smart they are, it’s much harder to tell how good they are at getting things done. On that dimension we’re practically reduced to guessing. So anything you can do to show us how good you are at getting things done will make us much more sure of you. A good demo multiplies the effect of however well you answer our questions.” – Official YC Interview Prep Guide

If you feel like the conversation or questions about the product are going in a different direction than you want take control of the meeting and gently direct the conversation back to what matters, using trigger words like, “What’s really important to understand is…”

If stuff goes wrong in the demo just keep going, exhplain, visualize, use the whiteboard, whatever – but don’t spend (waste) 2 minutes trying to fix something or start over. Imagine it is a piano recital – the audience doesn’t know how the piece is supposed to go so just keep going and they probably won’t even notice that you screwed up, or at least it won’t matter that much.

Beware the Curse of Knowledge

The Curse of Knowledge is a cognitive bias, and the number one thing I worry about for teams I prep with. Are you explaining things which is very detailed way that and requires inside knowledge which the interviewer may or may not have? You might be suffering from this cognitive bias. “But PG and RTM are interviewing me, surely they’ll understand!” you argue. They might. But they’re also going to be left wondering if you’re going to be helpless in communicating with and marketing to mere mortals. This behavior of dumping a deluge of information on the interviewer instead of essentializing and breaking it down into understandable chunks seems to be a natural fallback for coping with stress for many founders.

Buzzword bingo might be another flavor of the curse of knowledge, and tends to be spawned from the business guy mindset. This meeting is not the time to brag about what an awesome growth hacker you are, or drop names (well drop maybe one, and make sure that person is an investor or some other meaningful part of the company), or come off like an MBA douchebag. The only marketing stuff you should talk about in this meeting is how many customers you have, how you got them, what they’re saying, and how you plan to get more.

If you’re already launched, you should know everything you can about your users. Where do new users come from? What is your growth like? (Bring a printout of a graph.) What’s the conversion rate? What makes new users try you? Why do the reluctant ones hold back? What are the top things users want? What has surprised you about user behavior?” – Official YC Interview Prep Guide

Also, listen to Marina and the Diamonds and dance around the house when you need to de-stress:

-

Art Is Hard

My old startup died.

I have been working on my new startup.

It’s kind of named after this band I love, but not entirely.

New name, and we’ve got a long way to go.Art Is Hard

Cut it out – your self-inflicted pain

is getting too routine

the crowds are catching on – to the self-inflicted song

Well, here we go again – the art of acting weak

Fall in love to fail – to boost your CD sales

And that CD sells – yeah, what a hit

You’ve got to repeat it

you gotta’ sink to swimIf at first you don’t succeed

you gotta recreate your misery

’cause we all know art is hard

young artists have gotta starve

Try, and fail, and try again

the comforts of repetition

Keep churning out those hits

’til it’s all the same old shitOh, a second verse!

Well, color me fatigued

I’m hiding in the leaves

in the CD jacket sleeves

tired of entertaining

some double-dipped meaning

a soft serve analogy

This drunken angry slur

in thirty-one flavors

You gotta’ sink to swim

immerse yourself in rejection

regurgitate some sorry tale

about a boy who sells his love affairs

You gotta’ fake the pain

you better make it sting

you’re gonna’ break a leg

when you get on stage

and they scream your name

“Oh, Cursive is so cool!”You gotta sink to swim

impersonate greater persons

’cause we all know art is hard

when we don’t know who we are -

Double Tap

Last night I logged into Referly for the first time in a few weeks. I’ve been trying not to do that, because there are still so many things I want to fix and when I see them I just… and I was so in love with it and it’s just… and knowing that we aren’t continuing in this direction it just… hurts. It hurts.

I logged into the admin panel. I don’t know what I expected to see. If you’ve ever wondering what would happen if you stopped working on your startup I can tell you now so you don’t have to satisfy your morbid curiosity.

If you stop working on your startup, it dies.

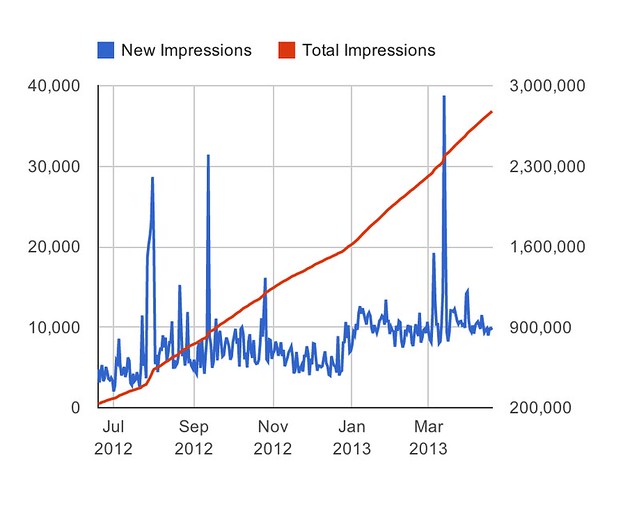

None of this four hour workweek perpetual motion machine bullshit. It dies, or in our case it lingers on the brink of death. I’m still amazed that we have so many pageviews a day with nothing, no tweets, no Facebook posts, no blogging, no efforts to drive traffic or create new content at all (I had to let go of all our lovely writers). We turned off all our automated emails to customers, it’s been a month since we’ve sent them anything new, there are no new features (we let our engineers go too). It’s just me, Kevin and Andy now. The team went from 8 people to 3 in 24 hours. I couldn’t even go to our office for a week, it was too sad sitting there with those empty desks.

(But don’t you dare feel sorry for me, I did all this myself.)

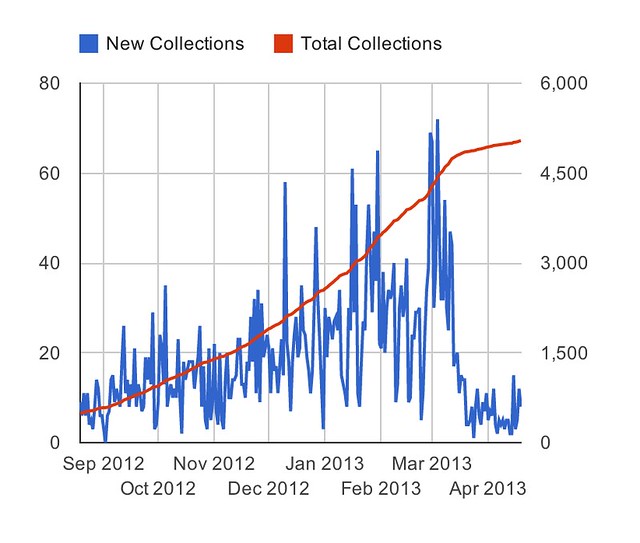

It would be so easy to rationalize a case for “it’s working on its own, maybe you really have something here”. 8 new collections were made today, and 12 yesterday, and 5 the day before that… and I’m just wondering, who *are* these people? And 5 people signed up today. And 20 people logged in. Oh god, I’m actually tearing up because 175 new items were added to profiles today and these graphs look like… Actually, it kind of looks like the site is just doing its thing without us. It’s not growing, but it’s not dead.

This is why zombies are the worst, they suck you in and prey on your worst fear.

Did I make a huge mistake shutting this down?

I was so good until last night! I didn’t do this for 40 days… but on the 41st I gave in. I opened my editor tools to review all the new collections being created lately, the ones making the graph look like a weak little heartbeat.

It’s all spam.

Sigh. Now I remember why we shut this down. Back to work.