To get the full effect, press play on the track above and start reading.

—

This post is a more in-depth commentary following our announcement yesterday that Referly will discontinue paying users cash rewards for generating purchases at the end of this month. Referly has pivoted and you can read more about our new direction here.

My greatest fear as a startup founder isn’t to fail, it is to become a zombie startup. Kind of like in the 6th Sense when Bruce Willis doesn’t realize he is dead and tries to have a nice dinner with his wife, there are startups out there who are still “operating” but might as well not be.

My greatest fear as a startup founder isn’t to fail, it is to become a zombie startup. Kind of like in the 6th Sense when Bruce Willis doesn’t realize he is dead and tries to have a nice dinner with his wife, there are startups out there who are still “operating” but might as well not be.

It can take a long time to die. I’m not going to name any names, but you could simply cross reference yclist.com with alexa.com, and any company that shows little to no growth in web traffic in the past year that claims to still be operating is probably a zombie. Yes, even companies that focus on mobile or enterprise sales should see healthy growth in web traffic at the early stage.

With just the $150,000 each of my Y Combinator batchmates received last summer, many can continue to work on their company or change direction several times. It has been 6 months since Demo Day and I don’t think anyone has officially died. So I’ll say it. Referly died. It’s not the kind of dead where the website goes dark and everyone gets jobs somewhere else. But the idea that we started with turned out to be the wrong one, so we killed it and yesterday I acknowledged publicly to ourselves and everyone else that we have to change our course.

Helpful Things Investors Say

Over the summer when the seed market was hot and we were raising money pre Demo Day like gangbusters I seriously considered raising our Series A, or some kind of Series Seed style equity round. To feel out the situation, I spoke to some investors who had already put money into Referly and asked them what they needed to see from us in order to raise the equity round we were contemplating. I’ll never forget this feedback, which I will paraphrase since I didn’t write it down:

“The biggest problem we see with early stage companies coming out of YC, or really any program, is that they’ll approach a year or two after they’ve graduated to raise a seed round. It’s exciting to see they’re still alive and pursuing their vision, but then we ask about the growth of the team and the ways they’ve been capturing the opportunity of the business in the time they’ve had… and discover everything is the same. The same 2 or 3 people, the exact same idea, very little growth around key metrics like engagement or revenue. So why should try raise a series A? What have they proved?”

Ride or Die

Sometimes I feel caught between two mindsets, one that encourages me to be a cockroach and survive no matter what and another that inspires me to overcome my fear of flying and take it to the next level circumstances be damned.

The biggest reason to charge ahead is that I don’t want to waste a single moment of my life in denial, in deadlock, in zombie mode waiting for something I can’t control change or expecting magic to happen. It goes beyond not wanting to. I simply can’t, won’t, would never give up precious days, weeks, months, years. And it’s not that I don’t have endurance for the schlep, but I can only summon that super-human power to fight for the right thing.

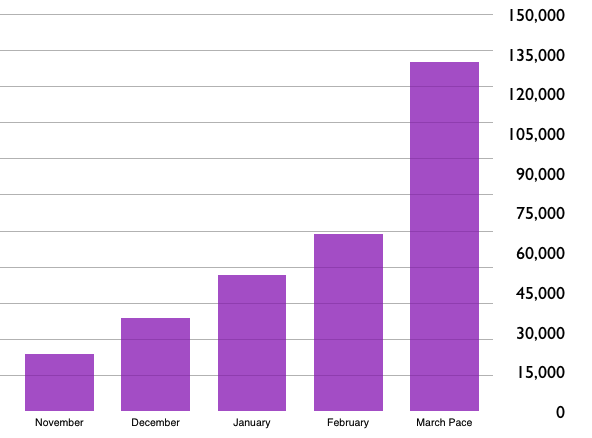

Referly Monthly Active Users

I bet if you showed this graph to investors many would tell you your startup is doing GRRRRRRREAT! For a blogging platform (where we’red headed next) this is awesome – for an affiliate referrals site this doesn’t matter. It’s all about revenue, and it wasn’t climbing at a commensurate pace.

Is Your Startup a Zombie

How do you know if you startup is falling into this trap? Here are some hints:

- You don’t want to get out of bed in the morning

- You don’t want to go out in public for fear you’ll have to explain what you do

- You haven’t hit 10% week-over-week growth on any meaningful metric (revenue, active users, etc)

- You’re working on the same idea after 12+ months and still haven’t launched

- You’ve launched a consumer service and have less than 2% week-over-week growth in signups

- You’ve launched an enterprise service and have less than 2% week-over-week growth in revenue pipeline

- You are the CEO and hole yourself up in the offices so you don’t have to talk to employees and can read TechCrunch

- You’ve hired consultants to figure out revenue, culture, or product in a company of less than 10 people

- You’re at SXSW right now reading this post and trying not to cry

Update: I’m not saying you need to hit 10% growth every week, but you should have hit it at some point like launch or some other PR event.

Turning Things Around

Does any of this sound familiar? If so, don’t panic – you can fix this. The first thing you need to do is acknowledge the reality of your situation. From there, figuring out what to do next is a lot harder and a very personal and contextual decision, but you should embrace it with vigor. Don’t waste single moment of your life, or the time of those on your team, to begin plotting the next step. Paralyzed? Yeah, I know that feeling. Just plow through it, there really is no other solution. Along the way you may consume dozen of beers/shots with good friends over long circular discussions they tolerate because they love you. Do that, and then get back to work.

I’m not an expert at figuring out what to do next, I mean I just changed course on an idea that took me 3 years to start and another year to prove didn’t work. But whatever… the point is that no one is going to tell you that your company is a zombie. Except me. Don’t waste your 20s, or 30s, or 40s being a zombie.

Worst Case Scenario

Flame out hard. That’s my only backup plan, because doing the silent fail is for boring. Failing is failing – do it up right!

Zombie — Photo Credit: jamesrdoe on Flickr

Seriously amazing that you put it all out there. Thank you!

I’m thrilled for you that you saw the signs, read them correctly, and are pivoting. We don’t know each other (yet!) but I really feel gratified that one of the most courageous entrepreneurs I’ve seen in a long time is also a woman.

I’ll volunteer my support for the new Refer.ly in any way I can help. Just say the word.

You GO, girl.

Great article…

I have a start-up that I have not been working on for 2 years, only recently came back to it after 24 months. I feel like I am much better prepared to do it again. I earned my PMP and now understand the ideal way to manage projects. Also took the time to learn new technologies needed. Hopefully I can pull it all together. Wish me luck!

Andre Butters

Rental Home Depot

Good rational behavior. Too many would-be entrepreneurs sacrifice themselves on the altar of a no-longer-appropriate original vision. In my extremely limited experience venture specialists will most likely see this as a sign of business maturity, and credit you with the experience. Good luck with the restructured enterprise. The new direction seems more promising if experience from the open source world is anything to go by.

Your transparency is extremely admirable. Thank you for being so open, and I’m excited to see what Referly can becomes!

Love your energy, and would love to learn what other mountains you’re ready to conquer. Health, gaming, rewards ? Waiting for that ahha moment can be exciting. Take a break, relax, start fresh.

Hi Danielle,

Great post, I always enjoy reading your content, ( web, tweets, blog etc.)

Good luck w/ your pivot – in what ever direction that takes you – hopefully you still have some cash to burn.

Super good! (especially for those non YC founders)

If you had gone forward with raising serious money from VC’s via an A round, you would not have the option of flaming out. Ever. It’s like joining the mafia. If you give up, you are whacked, as in dead, not fired. Getting fired would be a God send.

Exactly what I was about to comment. If not sure about your idea, dont raise Series A. Ever. You’re locked with no exit. It’s indeed the mafia life.

@Danielle — I know this feeling well. Your list of symptoms hit the nail on the head.

@Matt — I’m a former founder/CEO from start-up that raised a small Series A on good terms but with shaky product/revenue direction. We never found our footing and now the company is a barely-profitable zombie. Getting fired was indeed a Godsend for me personally — otherwise I would be stuck working my guts out so my investors have a chance at (maybe) getting (some of) their money back. I would have never quit…but I certainly didn’t complain when I got fired.

Great post Danielle!

I admire and respect you even more than I did before 🙂

Wishing you all the best.

Pete

Would love to hear some of the reasons why referly was a concept you ended up proving yourself didn’t work, I’ve been interested in similar ideas to this for some time now.

Would love to hear some of the reasons why the initial idea of referly has been proven to not work. I’ve been interested in ideas similar to this for some time now.

Another uppity hipster girl who deluded herself into thinking she could be a techie. Stick to frying pans and making sandwhiches instead of wasting America’s VC money please.

Wanted to acknowledge your courage & heart. You saw clearly what was up, and took action! Also, the term “zombie startup” is great.

Your (unfortunately, in this case, self-)description of a walking dead startup is exactly on target. The recent glut of seed capital in the Valley, combined with significantly lower costs of launching a startup here have resulted in many of these. The real cost on the overall ecosystem is the trapped talent — brilliant people that should be starting or joining something new, stuck in zombie startups. Good job listing out the symptoms — more teams, especially “pre-funded” ones, like the recent YC classes should take the time to breath on that mirror.

–Max

@mlevchin

Great post Danielle, but it’s the struggles that make us appreciate what we have. 🙂

Well articulated thoughts. I think the problem with most of the entrepreneurs is that they tend to be very emotional with their startup (the reference to “my startup is my baby”). This leaves them with never having to realize that the startup is dead!

If building a startup may be seen primarily as an optimization process, how do you make sure you reached the local maxima of your idea ? The criteria you suggest are unreliable because most are not objective.

If optimization is not making progress, you should first try different methods which in practice mean explore new marketing strategies. This is what Dropbox did and it succeeded.

So to me the question is if one really has exhausted all the marketing strategies. This is hard to tell. What we can more easily determine is the business potential of an idea. And this is what Dropbox had. They knew there was a strong interest in their vision. They just had to find the right marketing button, which they did.

So there is a distinction to make between bad startup business and bad execution. In the later case a “spark” could totally and suddenly change the outcome.

I love the honesty here Danielle. This is the truth of startup life! If only more founders would be this honest :).

You make it sound so easy but I bet you’re hurting inside. Years of sweat and blood goes into building a startup and it takes a lot of courage to acknowledge that it’s time to move on. One way to deal with it is to consider everything you’ve done as sunk costs, you can’t change the past, but going forward you can take everything you’ve learned and start with renewed vigour and a blank slate. I believe this is one of the things that separates entrepreneurs from the rest of us.

No spoiler for the second sentence?

“Kind of like in the 6th Sense when Bruce Willis doesn’t realize he is dead and tries to have a nice dinner with his wife”

Now I don’t want to watch the movie anymore 🙁

I guess the statute of limitations on that spoiler alert is long gone!

Hi Danielle-

I don’t see this to your fans or the Refer.ly post to your current customers as all that insightful as a CEO’s post-mortem for a failed idea.

What was your original VISION behind Refer.ly? What was your map of the world and your chosen path toward a realizable future? How did this map/path not match the stark reality of the world you inhabited?

What were your GOALS at the outset? What were those quantifiable metrics that, upon achievement, would signal success against your vision? If, as you claim, MAUs aren’t relevant for an affiliate driven site and revenue growth is, why show MAUs in your post-mortem? This isn’t owning your decision. This isn’t transparent. Is it a symptom of the same condition that led you to the vision in the first place? Dig deeper, explore and own.

Finally, what was the STRATEGY you employed to achieve the goals that expressed the vision? Did you iterate, if so why, and how quickly and cheaply was each cycle done? As a press/self-appointed growth hacker, I’d have expected a lot more here. Your strategy involved attracting two sets of customers, retailers with affiliate programs looking to increase sales and bloggers looking to earn money. Which part of your two-sided marketplace didn’t work? What did you try? What insights did you gain?

To be your own harshest critic, you must ask yourself the right questions – you’ve posed a great generic condition for a zombie startup, but not specifics as to why Refer.ly had become one along the lines I detailed above. To retain the trust of your stakeholders – employees, investors, retailers, bloggers, cheerleaders, etc. – answer those questions in public. No need to navel gaze, but you can rip the Band-Aid off quickly.

I say this all in the spirit of wanting you to win. Now go win.

-Greg

@gbattle

I just did the same thing with my start-up in December. It was clear that it wouldn’t work, so I shut it down, and went back to square 1. We ideated on problems we had that didn’t have solutions, pushed out an MVP at the end of January and have had good feedback so far. Still iterating on the product, but feel good about it’s potential.

Great post Danielle, and exactly what I’ve come to expect from you 🙂

Onward and upwards.

Thank you for the transparency. it’s really helpful as I decided on the fate of my own business.

What in your numbers made you decide to switch to a blogging platform?

Beautifully written article, Danielle. I wish some of my angel colleagues would recognize zombies earlier rather than feel compelled to do another round. Nobody likes to admit failure, neither the entrepreneur nor the investor. The “pivot” word just kills me. I think it’s overdone sometimes simply to give the entrepreneurs a new lease on life when the jig should be up.

Really, well done and thanks for the clarity and honesty. That alone assures your eventual success.

Take heart…”The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who errs and comes up short again and again, because there is no effort without error or shortcoming, but who knows the great enthusiasms, the great devotions, who spends himself for a worthy cause; who, at the best, knows, in the end, the triumph of high achievement, and who, at the worst, if he fails, at least he fails while daring greatly, so that his place shall never be with those cold and timid souls who knew neither victory nor defeat.”

Danielle: amazing post.

Especially liked the checklist of symptoms.

Great job.

Hell yes Danielle! Knock ’em dead.

Great post–Thanks for being so honest and putting this out there!!

Ha, I know I should comment on the content of your post, but I must say the combo of music and text was fantastic. Definitely a creative mind, that will do just fine. Best of luck, Danielle!

Kudos on the honesty. I think you probably helped a lot of people. I know it was useful for me. Best of luck on the new pivot.

great post. brave post.

now get back to work 🙂

DMC

Sry that u failed bro

Great post, I wish all entrepreneurs were as honest as you. Best of luck from London!

Well I can tell you one thing to do, get rid of that banner I can’t close at the top of the referly home page! That way we can see what’s there.

Other than that, great article.

we really need a platform that allows people to own their digital identities – not another tumblr, or blogger.com or about.me … tantek.com talks extensively about the idea, would be great to see refer.ly do the something in this vein.

I like it becuase it is very easy to fall in this phase, particularly if you have cash. SOme times chas scarcity is a way to avoid this face, without dying in the process of course.

I like it as well because you are showing an attitude towards life itself, not only business which is what is all about.

I have no doubt you will be successful.

I went through the zombie phase with my company, we woke up and turn, we had a pretty good ride but we failed in the end.

best of luck

Nice spoiler alert on The Sixth Sense …. sheeeesh.

Great post!